2017 Was the Year to Invest, 2018 To Be Continued

By Anthony

2017已经结束,2018即将开始。每年岁末年初时,投资者都会总结过去的投资回报和成果,并考虑来年的投资计划。在刚刚过去的一年中,特朗普的贸易战争言论、中国经济问题以及中东地区不断的地缘冲突等不确定性对经济和投资都产生了较大的影响。总体而言,虽然2017年中国的市场情况面临很多风险,但在市场波动中,这些风险已得到缓解,2017年中国股市呈基本上涨态势。

2017已经结束,2018即将开始。每年岁末年初时,投资者都会总结过去的投资回报和成果,并考虑来年的投资计划。在刚刚过去的一年中,特朗普的贸易战争言论、中国经济问题以及中东地区不断的地缘冲突等不确定性对经济和投资都产生了较大的影响。总体而言,虽然2017年中国的市场情况面临很多风险,但在市场波动中,这些风险已得到缓解,2017年中国股市呈基本上涨态势。

去年中国股市的回报率不一,但各项指数和ETF表现优于其他。香港股市在过去一年上涨了32%,甚至高于被高估的道指(年末上涨了24%)。此外,摩根士丹利(MSCI)的中国基金高达50%,中国50强股票则上涨了22%。总的来说,股市行情使一些投资者对2018年有更多期待。

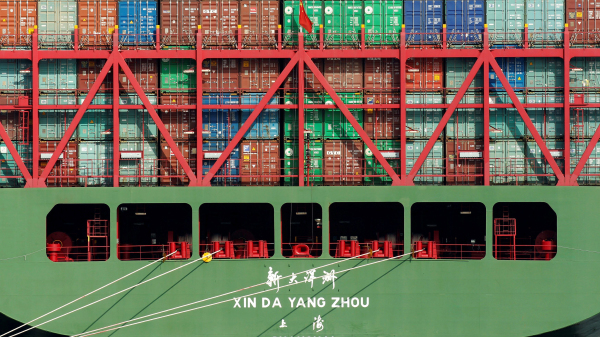

尽管中国股市有所增长,但经济增长、工业总产值、进出口的增速均大幅下降。这可能是由于习主席打击国企浪费行为以及房地产价格虚高所产生的影响。总之,全球股票在2017年大部分时间都在上涨,股市的上涨清楚地表明了投资者对中国的信心。

在2018年来临之际,我们可以看到,很多趋势并不明朗。特朗普总统对朝鲜剑拔弩张的态度似乎并没有取得什么成果,对中国的制裁行动也并不显著。

更重要的是,在2018年,大家将会看到一个在习主席领导下的更加强大的中国,在国企改革、房地产市场整顿以及对外经贸发展方面都更加自信有为的中国。

Every year it is important to take a look back on returns and how your portfolio turned out. Doing this helps investors assess the risks taken, bask in their successes, or wallow in their failures. At the beginning of the year, geo-economic spectators were nervous on many fronts including the uncertainty surrounding Trump’s rhetoric of a trade war, Chinese economic problems, and other issues such as Middle Eastern conflicts for example. And of course, everyone is smart with 20-20 vision, but these were all quite legitimate reasons to be nervous. Overall, 2017 seemed to hold many risks in China, but those have been alleviated and replaced with other risks on the upside and downside.

Chinese Stocks in 2017 Were Mostly Up

Chinese Stocks in 2017 Were Mostly Up

Equities in China for 2017 saw mixed bag of returns, but specific indices and ETFs fared better than others. China’s Shenzhen composite is up 16% year to date while the Shanghai composite is up a more modest 5% return year to date. Meanwhile Hong Kong’s stock market was up 32% in the past year which is even higher than the overvalued DOW Jones which saw a 24% rise year on end. Furthermore, MSCI’s China fund is up a whopping 50% while the China 50 (top 50 Chinese equities) was up 22%. Overall, Chinese equities were on a tear for the year which saw some investors with a lot to look forward to in 2018.

China’s Economy Slows

China’s Economy Slows

In spite of this growth in China’s equity markets, the economy slowed down significantly in terms of growth, overall industrial output, exports, and imports. How can this be the case? Although economic estimates were higher than expected, we are now beginning to witness a China with much lower growth than what has previously been the case over the last 30 years or so. This was bound to happen, but still does not account for the disparity between statistical figures and equities. This could be the result of Xi’s success in clamping down on wasteful spending in SOEs, companies which dominate China’s stock markets. Regardless, global equities have all been up for most part in 2017. That said, the rise in stock markets clearly indicates investor confidence in the Middle Kingdom.

Consolidation of Economic Power

Consolidation of Economic Power

And with 2017 in the bag, we can see a number of trends that will make 2018 a bit less obscured. Firstly, it is quite obvious that President Trump is the weakest US president in modern history. This means the effect of his saber-rattling against North Korea has transformed from market-moving to eye-rolling. His ability to take action against the Chinese by levying sanctions is minimal and even targeted tariffs against specific industries have ripple affects that would hurt US industries. For example, when Trump threatened to introduce steel tariffs against cheap Chinese steel, the US wheat industry (the largest in the world) warned that this could trigger other countries to use similar tactics against cheap US wheat exports.

More importantly, 2018 will see an incredibly confident China that is politically consolidated around President Xi Jinping even more so than had previously been the case. This translates into much more flexibility for Xi to tackle many economic issues such as provincial debt, the housing bubble, zombie SOEs, and macro-economic policy in general. It also means Xi will be much less likely to help Trump put economic sanctions on the North Koreans since there is really no reason why China would cooperate with the US on this in the first place. But with the passing of the 19th Party Congress, Xi can now gradually ensure stability.

More importantly, 2018 will see an incredibly confident China that is politically consolidated around President Xi Jinping even more so than had previously been the case. This translates into much more flexibility for Xi to tackle many economic issues such as provincial debt, the housing bubble, zombie SOEs, and macro-economic policy in general. It also means Xi will be much less likely to help Trump put economic sanctions on the North Koreans since there is really no reason why China would cooperate with the US on this in the first place. But with the passing of the 19th Party Congress, Xi can now gradually ensure stability.