Medical equipment manufacturers show remarkable performance

By Morgan Brady

医疗设备制造业最近表现非常好,随着外国投资者越来越多地关注中国的高科技行业发展并把投资目光更多地转向医疗设备制造商,医疗器械生产制造业的规模扩大了五倍之多。

医疗设备制造业最近表现非常好,随着外国投资者越来越多地关注中国的高科技行业发展并把投资目光更多地转向医疗设备制造商,医疗器械生产制造业的规模扩大了五倍之多。

今年前4个月,医疗器械制造业规模同比增长了321.8%,投资者与业内乐观预期推动了行业的规模扩大。2010年至2016年期间,该行业的复合年增长率为19.765%,这使得医疗器械制造业成为全球第二大行业。预计未来几个月还将有更多的投资流入此行业。其中,部分知名公司吸引了众多投资者注意:

爱尔眼科医院集团股份有限公司成立于2003年,是一家相对年轻的公司。该公司的规模在过去五年中大幅增长,其股价从每股5元飙升至33元。公司为医院提供眼科手术相关服务,同时还提供眼科整形手术。该公司在2017年的年利润率为12.48%,在医疗行业收入榜单中排名第三。新华医疗是2017年该行业最出色的公司之一,其收入与其他医疗企业相比最高,约为45.1亿元。该公司成立于1943年,目前市值为66.04亿元。

基于我国政府对医疗器械行业给予的关注,我们可以预见中国医疗器械行业将实现进一步增长。然而,由于西门子、通用电气医疗和飞利浦医疗等外国公司在中国本土的强大实力,国内制造商仍需努力保持灵活性和竞争力。

总体来看,医疗器械制造业正处于增势,未来市场前景不错,不过竞争激烈。年轻的公司可以通过专注于技术创新并削减成本,在激烈的竞争环境中争得优势。

Medical equipment manufacturing sector has shown a remarkably good performance recently, particularily in receiveing capital from abroad, as it has received the lion’s share of foreign direct investments. The sector has increased five folds in size, as foreign investors are becoming increasingly attracted to China’s high-tech sector with focus on medical equipment manufacturers.

The annual growth rate of medical equipments manufaturing sector reached 321.8% during the first 4 months of the year, on a year on year basis. This was driven by investors’ optimism about the sector and its high potential, as well as less tightened retrisctions on capital flows. The sector ranks as the second largest on a global scale, with a compounded annual growth rate of 19.765% in the period from 2010 to 2016. Further investment flow is expected over the following few months, and some official Chinese government bodies expect the market to grow by around 10% each year in the following few years.

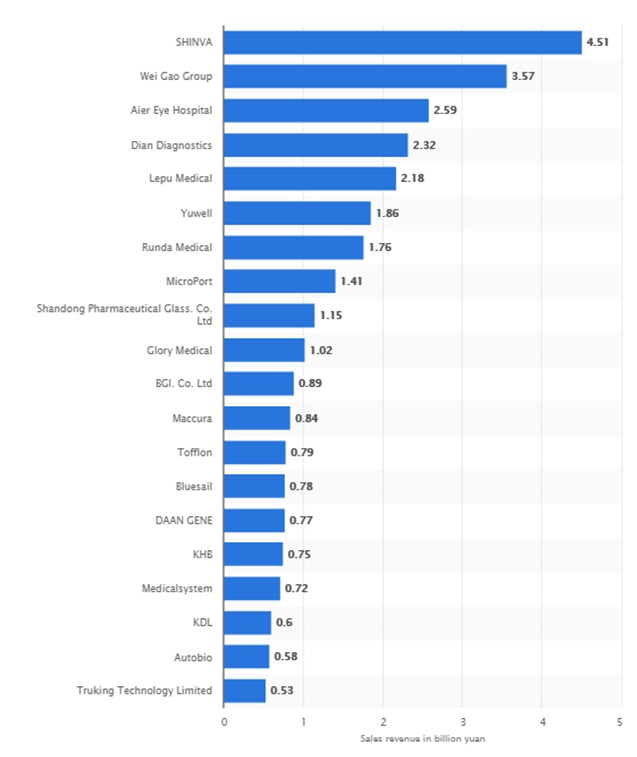

Among the best performers in the sector are Shinva, who achieved the highest revenue, and Aier Eye hospital, whose share performance is also commendable.

Figure 1: Companies performance in the medical devices sector - 2017

Figure 1: Companies performance in the medical devices sector - 2017

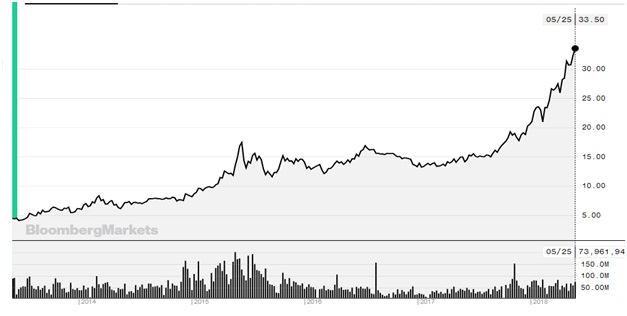

Aier Eye Hospital

A relatively young company, Aier Eye hospital group was founded in 2003. The company has grown in size significantly over the last five years, as its stock price surged from 5 Yuan to 33 Yuan. The company provides services related to eye surgery and a variety of eye problems, such as surgery for myopia; prevention and control of myopia; and treatment for cataract, glaucoma, pediatric ophthalmology, eye disease, lacrimal disease, and corneal and ocular surface. It also provids eye plastic surgery. The company was ranked 3rd in terms of revenue in the medical sector in 2017.

The company’s financials are very healthy, with a one year return of 122.6% (last year to date), and a price to earnings ratio of 93.21. Dividends averaged at 0.66%, and its profit margin in 2017 was 12.48%. The company seems to have outperformed many other companyies in the sector and it has even outperformed the company that ranked first in terms of revenue in other, more important measures.

Figure 2: Aier Eye Hospital stock - Bloomberg

Figure 2: Aier Eye Hospital stock - Bloomberg

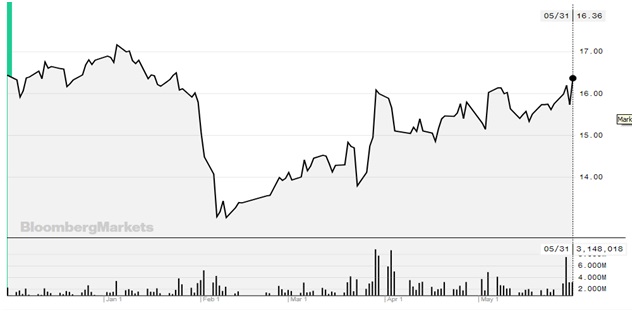

Shinva

Among the best perfomers in the sector in 2017 was Shinva Medical Instrument Co. Ltd. It was established in 1943, and today it has a market capitalization of 6.604 billion Yuan. In 2017, the company achieved the highest revenue in comparison with other medical manufactureres, with about 4.51 billion Yuan in revenue. This was higher than the revenue of Weigao group at 3.57 billion Yuan and Aier eye hospital at 2.56 billion Yuan. The company’s recent performance has fared better than the performance of the sector.

The company’s revenue has been growing throughout the years, with net income of 65.5 million Yuan in 2017. But despite this growth, profit margins have been declining, reaching 0.66% in 2017. Its total assets stood at 12 billion in that year, and its total liabilities at 8 billion Yuan.

The company’s stock tumbled during the last few years, but it has been showing signs of recovery recently. It still lags behind other companies in terms of market capitalization. For example, Aier Eye Hospital has a market capitalization of 78 billion Yuan (compared with 6.6 billion for Shinva).

Figure 3: Shinva stock - Bloomberg

Figure 3: Shinva stock - Bloomberg

Overview Of The Industry

The medical manufacturing sector has shown an impressive performance in the period from 2012 til 2017, growing at an annual rate of 15%. Performance has been even more impressive in the beginning of 2018. The sector remains attractive as markets are growing both locally and elsewhere, buoyed by the increasing purchasing power of hospitals and households, improved quality of life, and increasing demand for healthcare services in general. This demand has stimulated technology upgrades at hospitals, as there were requirements for higher quality medical equipment in the western region, which also strengthened the sector.

Further growth is expected given the attention that the Chinese government has given to the medical device industry and its efforts to control healthcare costs. Yet, local manufatureres still have to level up their efforts as foreign companies such as Siemens, GE healthcare, and Philips healthcare have strong presence in the Chinese market. Those companies are established market players and Chinese manufatureres need to remain agile and competitive to be successful.

Conclusion

A fivefold increase in the medical device manufaturing sector shows the sector is increasing its growth momentum. The sector has already been on a positive growth trajectory and further growth is expected up to the year 2019. The market is promising but competitive. Young companies can have a good advantage by focusing on innovation and cutting costs, while established players such as Aier Eye Hospital and Shinva, among others, can be good investment opportunities, although the former has shown significantly better performance than the latter.

Chinese market for medical equipment and devices is the second largest in the world, with many factors stimulating demand such as the aging population and the demand for higher quality of life. Manufcturing activity is mainly concentrated in two provinces and two municipalities: Guangdong Province, Jiangsu Province, Beijing and Shanghai. Demand in rural areas and second and third tier cities lags behind demand in major cities, but is anticipated to grow, adding another positive factor to support the industry over the coming years.