Implementation Rules and Measures of Additional Special Deductions to

New Individual Income Tax Law are Seeking Public Comments

特别减免的附加实施细则和措施

特别减免的附加实施细则和措施

新的个人所得税法正在征求公众意见

随着中华人民共和国个人所得税法(2018年修正案)的出台,财政部和国家税务总局发布了关于就“中华人民共和国个人所得税法实施条例”征求公众意见的通知(修订征求意见稿)(“新实施细则”)和关于征求公众意见“关于增加特别扣除暂行办法”的通知。新实施细则和暂行办法澄清了一些未在IIT法2018中规定的问题。

财政部和国家税务总局仍在寻求公众意见,以下内容可能会有所变更,直至新实施细则和临时措施最终确定并具有法律效力。

1.新的实施细则

1.1在中国没有住所的个人所得税负债

1.2“其他减免”的范围

1.3针对个人的反避税IIT规则

1.4税收抵消方法

1.5中国税务居民计划移民和取消其中国家庭的税务合规手续

Following the introduction of the Individual Income Tax Law of the People's Republic of China (2018 Amendment) (“IIT Law 2018”), the Ministry of Finance (“MOF”) and the State Administration of Taxation (“SAT”) has issued the Circular on Seeking Public Comments on the Implementing Regulations of the Individual Income Tax Law of the People’s Republic of China (Revised Draft for Comment) (“New Implementing Regulations”) and the Circular on Seeking Public Comments on the Interim Measures for Additional Special Deductions for Individual Income Tax (Draft for Comment) (“Interim Measures”) on October 20, 2018. The New Implementing Regulations and Interim Measures have clarified a number of issues that have not been specified in the IIT Law 2018.

As MOF and SAT are still seeking public comments, the contents below are subject to change until the New Implementing Regulations, and Interim Measures are finalized and become legally effective.

1. New Implementing Regulations

1.1 IIT liabilities of individuals who do not have a domicile in China

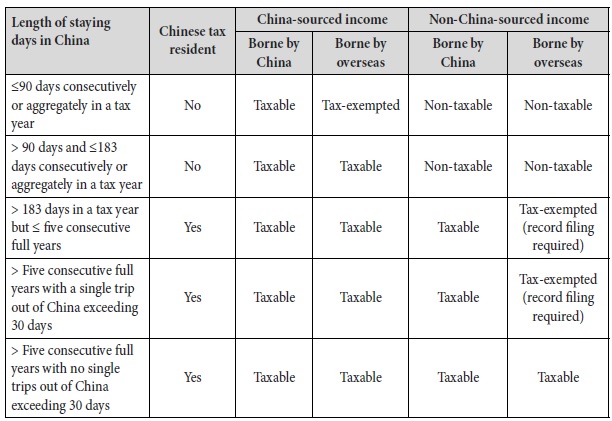

According to the IIT Law 2018, the global income of a Chinese tax resident is subject to Chinese IIT, but a non-Chinese tax resident is only liable for the individual income tax (“IIT”) on China-sourced income.

The New Implementing Regulations further specify and supplement the IIT liability of an individual who does not have a domicile (“Non- domicile Individual”) in China. A Non-domicile Individual could be exempted from overseas sourced income borne by an overseas employer, provided that: (a) living in China for 183 days during a tax year (i.e. January 1 to December 31) but lasting no more than 5 consecutive years; or (b) living in China for 5 consecutive years with a single trip out of China exceeding 30 days. Moreover, the global income of a Non-domicile Individual living in China for 5 consecutive years without a single trip out of China exceeding 30 days is subject to Chinese IIT, provided that the Non-domicile Individual stays in China for more than 183 days in the sixth tax year.

The IIT liability of Non- domicile Individual is shown in the table below:

1.2 The scope of ‘other deductions’

New Implementing Regulations have clarified the scope of ‘other deductions according to the law’ which were mentioned in Article 6.1 of IIT Laws 2018. Other deductions (which are consistent with the prevailing regulation but were not specified in the old IIT implementation rules) include:

- Enterprise annuities;

- Occupational annuities;

- Tax-deductible commercial health insurance;

- Tax deferral commercial pension insurance; and

- Other items that may be deducted as specified by the State Council.

If the sum of special deductions, Additional Special Deductions (defined in section 2) and other deductions (“Deductions”) exceeds the amount of the annual taxable income of an individual, the rest of the Deductions could not be carried forward to the following years.

1.3 Anti-avoidance IIT rules on individuals

IIT Law 2018 has introduced the concepts of ‘related parties’, ‘control’ and ‘deemed sales’ for anti-tax avoidance purpose.

1.3.1 Definition of related parties

The related parties of an individual as mentioned in Item 1 of Article 8.1 of IIT Law 2018 include the following individual, enterprise or other economic organizations:

- Spouse, lineal descent, brothers or sisters, and other supportive relationships;

- Direct or indirect control of funds, operations, purchases and sales, etc.; or

- Other economic interest relationship.

The transactions between related parties shall comply with the arm’s length principle, meaning that the related party transactions should reflect the fair market value.

1.3.2 Definition of control

The following situations will be regarded as ‘control’, which is mentioned in Item 2 of Article 8.1 of IIT Law 2018:

- A resident individual or a resident enterprise directly or indirectly solely holds more than 10% of the voting shares of a foreign enterprise, and holds more than 50% of the shares of the foreign enterprise jointly with others;

- The shareholding ratio of a resident individual or resident enterprise does not reach the abovementioned standards, but the resident individual or resident enterprise has substantial control over the foreign enterprise in terms of shares, funds, operations, purchases, and sales.

The said ‘lower tax rates’ mentioned in Item 2 of Article 8.1 of IIT Laws means that the actual tax burden is lower than 12.5%.

1.3.3 Deemed sales

When the assets are used to perform non-monetary asset exchange, donation, debt repayment, sponsorship, investment, etc., such actions shall be regarded as deemed sales and are subject to IIT.

1.4 Tax offset methodology

New Implementing Regulations have clarified the tax offset methodology for Chinese tax residents who have paid IIT in other jurisdictions, including:

- The offset limit of comprehensive income is calculated as Percentage of comprehensive income derived from other jurisdiction * Total IIT payable on China-sourced and non-China-sourced comprehensive income according to PRC IIT Laws;

- The offset limit of trading income is calculated as Percentage of trading income derived from other jurisdiction * Total IIT payable on China-sourced and non-China-sourced trading income according to PRC IIT Laws;

- The offset limit of other income is the IIT payable calculated according to PRC IIT Laws.

1.5 Tax compliance formalities for Chinese tax resident plans to immigrate and de-register their Chinese households

Implementing Regulations have specified the tax compliance requirements to those individuals who de-register their Chinese households and plan to immigrate to another country (“Immigrant”). Immigrant shall file the following information to the tax authority:

- Tax reconciliation status for comprehensive income and trading income of the current year;

- Tax payment status for other income of the current year; and

- Tax compliance status in previous years.

2. Interim Measures

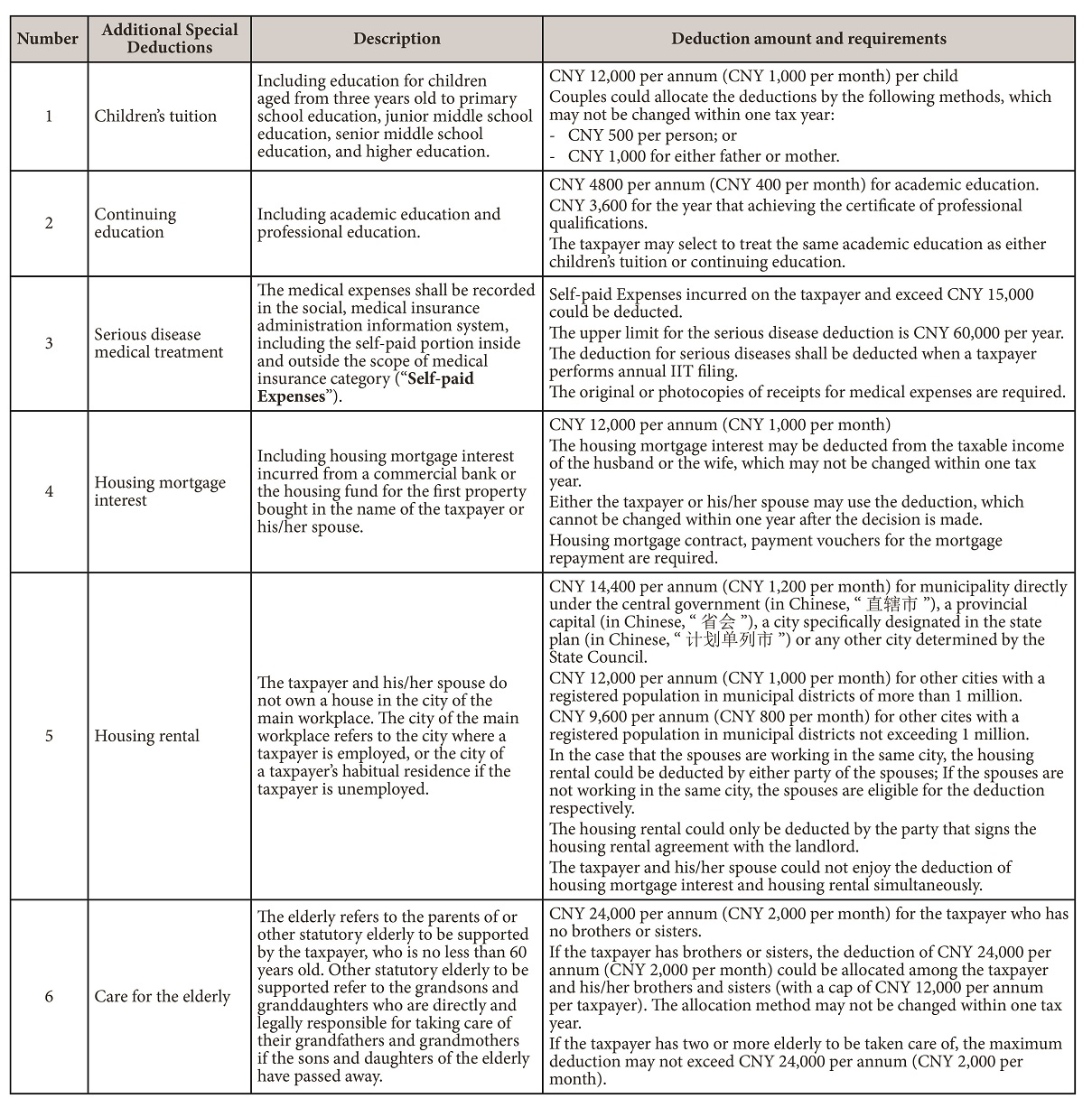

IIT Law 2018 provides a number of additional special deductions (“Additional Special Deductions”) on comprehensive income for tax residents, such as children’s education expenses, continuing education expenses, medical expenses for serious diseases, interest on housing loan and rental expenses, etc.

New Implementing Regulations clarify the deduction method of Additional Special Deductions, which are summarized in the table below.

Foreign individuals could select to treat children's tuition and house rental payments as either Additional Special Deduction items or tax-exempted benefits, but may not enjoy both at the same time.

Foreign individuals could select to treat children's tuition and house rental payments as either Additional Special Deduction items or tax-exempted benefits, but may not enjoy both at the same time.

3. Garrigues’ comments

New Implementing Regulations have clarified a number of uncertainties in IIT Law 2018 as explained above. Nevertheless, the following issues are expected to be further addressed or revised:

- As the tax residence assessment has changed under the IIT Law 2018, does the tax residence status assessment made under the old IIT rules for previous years count as the ‘five consecutive years’ as mentioned in section 1.1?

- Regarding the concept of ‘deemed sales’, would there be any IIT exemption applicable (such as property transfer from parents and donation to charities)?

- The employees who have suffered serious disease may not have the work ability. The deductions shall be eligible to the employees’ family members such as spouse or children.

- If a tax resident is a Non-domicile Individual whose parents are usually resided in overseas countries, can the Non-domicile Individual enjoy the ‘Care for the elderly’ deduction?

This publication contains general information, without constituting a professional opinion or legal advice.

December 2011. J&A Garrigues, S.L.P., all rights reserved. The exploitation, reproduction, distribution, public communication and total and partial transformation of this work is prohibited without the written authorization of J&A Garrigues, S.L.P