MEGVII

Finding A Path Forward Despite The Challenges

By Morgan Brady

The competition to reach supremacy in the AI arena is intense. The industry has geopolitical, strategic, and security implications for countries and governments. And it seems that China is making headway in that area with various companies showing excellent performance. One of those companies is Megvii Technology.

The competition to reach supremacy in the AI arena is intense. The industry has geopolitical, strategic, and security implications for countries and governments. And it seems that China is making headway in that area with various companies showing excellent performance. One of those companies is Megvii Technology.

The company works in the domain of developing AI technologies. It develops an AI engine, and it is famous for its Face++ facial recognition brand. Its AI technology also powers sensor networks. Megvii's tech has successfully enabled more than 500 million IoT devices.

Face++ is Megvii's open platform for AI developers, enabling them to use facial and body recognition, as well as text and objects. More than 300,000 developers from more than 210 countries have taken advantage of Face++. Megvii's FaceID has provided real-name authentication services for 295 million people globally, in such sectors as banking, insurance, securities, and digital finance. Face++ is the country’s largest cloud-based identity authentication platform, and through it Megvii processed about 2.4 million face ID verification requests on an average day from its over 1,100 corporate customers in the first six months of this year.

Yin Qi, co-founder and chief executive of Megvii Technology

Yin Qi, co-founder and chief executive of Megvii Technology

Megvii was founded by three Tsinghua University graduates in 2011, and today it serves high profile clients, such as Alibaba, Ant Financial, Lenovo, China Mobile, and Chinese government entities.

近年来,中国在人工智能领域取得了很大进展,有很多公司表现抢眼。总部位于北京的人工智能创业公司旷视科技以人脸识别品牌 Face++而闻名。北京旷视科技有限公司成立于 2011 年,是全球领先的人工智能科技企业,以自研视觉感知算法引擎为核心,致力于持续打造在各商业领域的 AIoT 操作系统,以及深度构建具备连接百亿物联网设备能力的生态系统。旷视持续聚焦算法与工程创新,通过底层统一的 AIoT 操作系统(AIoT OS)建设,旷视正在为 200 多个国家和地区的数十万开发者,及上千家行业客户提供智能物联服务及解决方案。旷视科技的客户包括阿里巴巴、蚂蚁金服、联想、中国移动,以及政府部门。

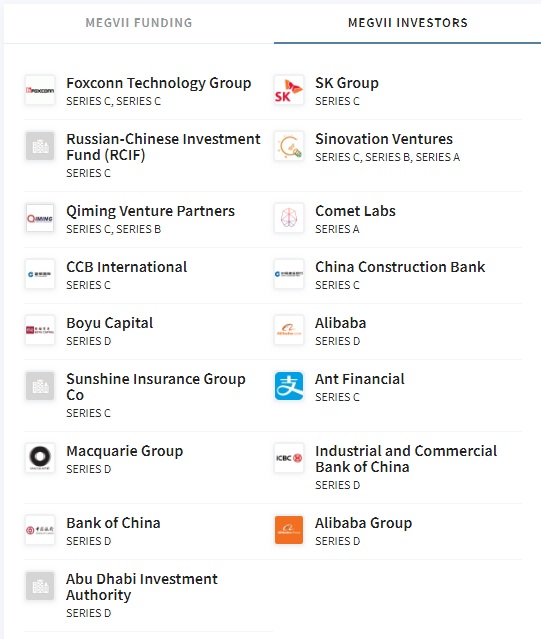

Funding

Megvii technology has gone through 7 funding rounds. It has raised through them the amount of $1.4 billion. Among its investors are Alibaba, Ant Financial and the Bank of China. A few months ago, Megvii had filed for a public listing on the Hong Kong stock exchange. However, the company decided recently to postpone the listing due to the uncertain situation in Hong Kong, among other reasons.

融资

融资

旷视MEGVII已完成总额7.5亿美元的D轮融资,本轮融资由中银投资、Macquarie麦格理和阿布扎比投资局等参与投资,这是旷视MEGVII成立八年以来的第7轮融资。旷视MEGVII成立于2011年10月,2012年8月接受来自联想之星和联想创投集团的天使轮融资。截至2019年5月8日,经历了几次融资之后,旷视MEGVII目前的股东包括中银投资、Macquarie麦格理、阿布扎比投资局、工银资管和中国国有资本风险投资基金(国风投基金)等。

IPO delay

Given its strategic importance, the company has been placed on the blacklist by the United States. The list now includes around 28 Chinese entities and it is issued by the US Commerce Department. Other companies on the list include SenseTime and Yitu. The blacklist mostly focused on companies involved in surveillance, facial recognition, and AI technologies.

Megvii responded and made clear statements in its recent IPO filing in Hong Kong that "we require our customers to covenant to us that they will not use our technologies for any illegal or inappropriate purposes, including infringement of human rights.” The company also announced that it formed an ethics committee to “consider ethical issues in our industry and our company - our contracts are structured to guard against weaponization and misuse of our technology.” The committee to oversee AI ethics-related issues and will brief the board on its decisions and recommendations, according to the prospectus. Integrity, human oversight, accountability, diversity, and privacy protection are among the eight core principles in the document.

The decision by the US and the event in Hong Kong prompted the company to delay its IPO. Megvii wanted to address the risk of not reaching a valuation of $4 billion following the offering, which could negatively impact the equity holdings of its current investors.

IPO延期

IPO延期

该公司已经申请在香港股票交易所上市。旷视科技的招股书没有披露 IPO 定价和具体时间,但报道称,该公司计划融资 5 亿到 10 亿美元,并于今年第四季度上市。旷视科技的投资方包括阿里巴巴、蚂蚁金服和中国银行。该公司于今年 5 月宣布了 7.5 亿美元的 D 轮融资,有报道称在当时的融资中该公司估值超过 40 亿美元。

Financial performance

In the prospectus the company published in relation to its intended IPO, it showed growing revenues. At the same time, it showed deepening losses, as well. Megvii’s revenue grew from 67.8 million RMB in 2016 to 1.42 billion RMB in 2018, which represents a compound annual growth rate (CAGR) of about 359%. In the first two quarters of 2019, it made 948.9 million RMB. Between 2016 and 2018, however, its losses increased from 342.8 million RMB to 3.35 billion RMB, and in the first half of this year, Megvii has already lost 5.2 billion RMB. The company said its losses are due to increased investment in research and development, among other factors.

财务状况

财务状况

旷视科技的招股书显示,该公司营收快速增长,但亏损也在扩大。该公司将亏损归因于优先股公允价值的调整和研发投资。旷视科技营收从 2016 年的 6780 万元人民币增长 2018 年的 14.2 亿元人民币,年复合增长率达到约 359%。2019 年前 6 个月,旷视科技的收入为 9.489 亿元人民币。与此同时,从 2016 年到 2018 年,该公司的亏损从 3.428 亿元人民币增长至 33.5 亿元人民币。今年上半年的亏损为 52 亿元人民币。

Governmental support

Governmental support

The Chinese government has played a key role in supporting Megvii’s rise. The company reported that it received government grants of RMB2.0 million, RMB63.3 million, RMB 92.0 million and RMB44.7 million as other incomes in 2016, 2017, 2018 and the six months ended on June 30th, 2019, respectively. The ratio of government subsidies to revenues stood at 3%, 20%, 6%, and 5% during 2016, 2017, 2018 and the first half of 2019, respectively.

Conclusion

Conclusion

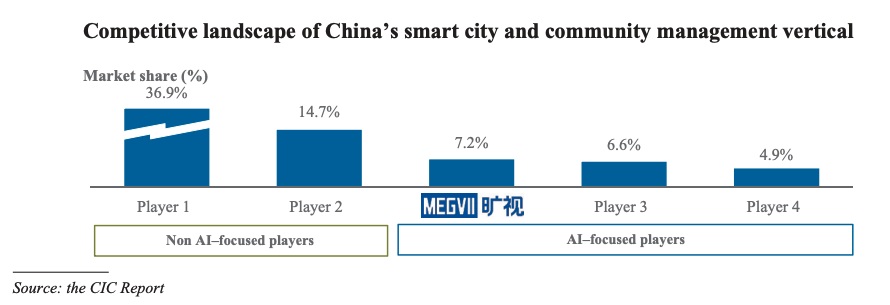

Megvii’s path ahead is rugged. It faces many risks that it is trying to deal with. First and most importantly, it is facing a reputational risk that is generally associated with facial recognition technologies. It has stated that it will guard against the weaponization of AI and voiced its support for human rights. In its prospectus the company made efforts to position itself as an IoT company rather than an AI company. Megvii is also facing a risk arising from operating internationally. Being blacklisted by the US, and the US-China trade war will hamper its business abroad. Thus, Megvii will need to focus more on its local businesses.

Still, the company has done many things right. It is the first among AI companies to seek to launch an initial public offering in Hong Kong. Its Co-Founder, Yin Qi, said that Megvii wants to build industries rather than disrupt them, and to offer solutions that respect people’s dignity and privacy.

In the short term, it may take a while before the company’s results improve. Over the longer term, the company still has a lead. At this point, an adaptive strategy is needed to meet the challenges. Once this strategy is formulated, the potential for this company is huge.

旷视科技未来之路注定不平坦,面临着声誉及国际经营的风险及挑战,短期内业绩也亟待改善。但从长远看,该公司在技术实力上处于领先地位,具有巨大的潜力。