China attract global automakers for NEV partnerships

By Sunny Liu

World attention on the fast-growing renewables sector has resulted in huge investments being attracted with regard to electric cars, plug-in hybrids and fuel cells.

World attention on the fast-growing renewables sector has resulted in huge investments being attracted with regard to electric cars, plug-in hybrids and fuel cells.

Auto manufacturer around the world are in competition to build alliances with Chinese companies as they push deeper to discover the potential of the latest wave of changes in the new energy vehicle sector.

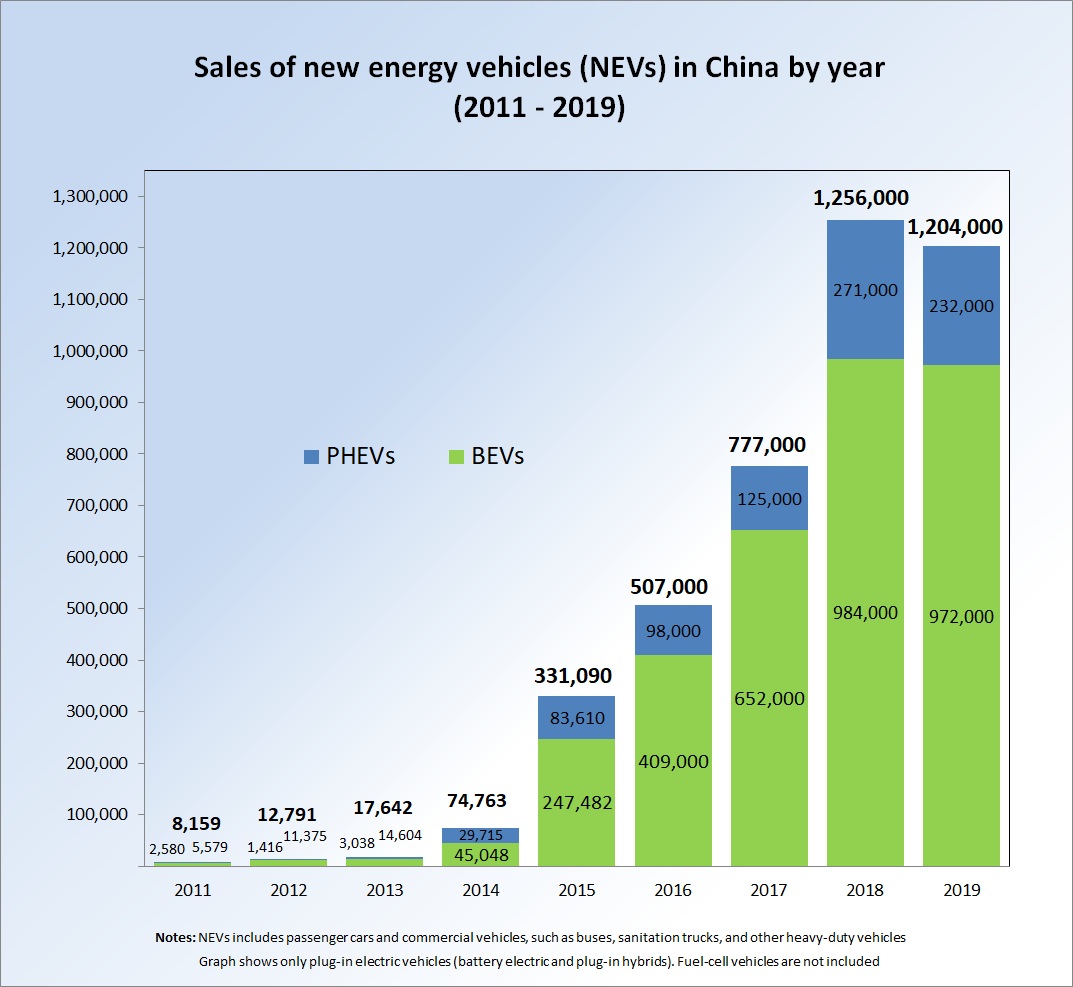

In the first half of 2019, combined sales of electric cars, plug-in hybrids and fuel cell vehicles exceeded 5% of total vehicle deliveries for the first time in China. The Ministry of Industry and Information Technology expects the figure to reach 25% by 2025. Foreign car manufacturers are being attracted by the government's ambition and prospects in the world's largest vehicle market to boost investment in China.

In August 2020, Japan's No 1 car manufacturer, Toyota, partnered with state-owned car manufacturer FAW, Dongfeng, GAC and BAIC, as well as Beijing SinoHytec Co, a Chinese fuel cell engine builder, to establish a Beijing research facility dedicated to fuel cell vehicles.

In August 2020, Japan's No 1 car manufacturer, Toyota, partnered with state-owned car manufacturer FAW, Dongfeng, GAC and BAIC, as well as Beijing SinoHytec Co, a Chinese fuel cell engine builder, to establish a Beijing research facility dedicated to fuel cell vehicles.

Toyota holds 65%, with a registered capital of 1.67 billion yen, of the joint venture, United Fuel Cell System R&D. The total investment in the facility is expected to grow to $50 million, as per their plan.

China’s ambition in the sector has been to attract the interest of Toyota, which is one of the biggest backers of fuel cell vehicles, betting they will become the ultimate solution in future transportation modalities.

A plan announced by China in 2016 mentions that it hopes to have 1 million fuel cell vehicles on the roads by 2025. A statement made by Toyota says that by working with companies that have considerable influence in China's commercial vehicle market, as well as SinoHytec, which has reliable technological capability, they believe that they will be able to establish the foundation for the widespread use of fuel cell vehicles in China.

Electrification efforts by General Motors are speeding up in the country as well. The largest auto manufacturer in the United States said that over 40% of its new models in China over the next five years will be electrified, and will be manufactured locally. As GM's largest market and a global centre of innovation, China is expected to play a crucial role in making their vision a reality.

German companies are partnering with Chinese battery manufacturers with the intention of gaining a better foothold in China and other markets.

A CATL battery plant in China

A CATL battery plant in China

Contemporary Amperex Technology Co Ltd., a global leader in the development and production of lithium-ion batteries, has been chosen by Mercedes-Benz as its major battery supplier. Its battery production capacity reached 40.25 gigawatt-hours in 2019. Mercedes-Benz hopes to accelerate their transformation toward carbon-neutrality in collaboration with CATL. The two companies have started working on battery products that will be used in vehicles within the next few years.

It was announced in July that Daimler is acquiring a stake of around 3% in Chinese battery cell manufacturer, Farasis Energy. Although an exact investment figure for the equity has not been given by the car manufacturer, it has been mentioned that it is investing "multimillions" of euros in Farasis' initial public offering on China's Nasdaq-like STAR board.

Daimler also stated that the company will be enabled to further leverage the potential of advanced technology partners to pursue its global electrification strategy by a stake in Chinese battery production.

China overtook the United States in 2015 as the largest market for electric cars, plug-in hybrids and fuel cell vehicles, and has since held the lead. Sales of such vehicles in China totalled 1.2 million, according to the China Association of Automobile Manufacturers, over the last year, but these sales could fall to 1.1 million this year because of COVID-19. However, Volkswagen AG has confidence in the sector's long-term potential and is determined to make the production of new energy vehicles in China a success.

China overtook the United States in 2015 as the largest market for electric cars, plug-in hybrids and fuel cell vehicles, and has since held the lead. Sales of such vehicles in China totalled 1.2 million, according to the China Association of Automobile Manufacturers, over the last year, but these sales could fall to 1.1 million this year because of COVID-19. However, Volkswagen AG has confidence in the sector's long-term potential and is determined to make the production of new energy vehicles in China a success.

The car manufacturer said it will not alter its sales goal of delivering 1.5 million new energy vehicles in China by 2025, regardless of the estimated fall in sales of such vehicle this year. The German car manufacturer is in the process of acquiring a 26% share in China's No 3 battery producer, Gotion. The 1 billion euros deal, which will make the German car giant Gotion's largest shareholder, is expected to be completed later this year.

Gotion has several projects over the entire battery value chain from sourcing, development and production to recycling. Volkswagen said Gotion will supply batteries to its three joint ventures in the country, two of which are making vehicles on Volkswagen's electric platform. The two models built on the platform are expected to launch before Spring Festival.