Will Shadow Banks Save Chinese Developers?

Written by Chelsea Cai, Head of Research in JLL Tianjin office

There has been much discussion about how investment and construction have been key drivers for the Chinese economy over the past several decades. This construction generally starts with infrastructure and residential property. Then as cities grow and diversify, retail and office property become important elements of this construction boom.

There has been much discussion about how investment and construction have been key drivers for the Chinese economy over the past several decades. This construction generally starts with infrastructure and residential property. Then as cities grow and diversify, retail and office property become important elements of this construction boom.

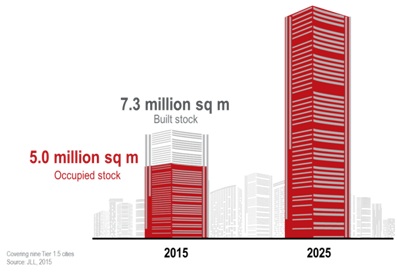

According to China City 60: From Fast Growth to Smart Growth, a report JLL released earlier this year, the existing stock of Grade A office space in China is still overwhelmingly concentrated in the four Tier 1 cities (Beijing, Shanghai, Guangzhou and Shenzhen). They account for nearly two-thirds of all Grade A office space in China. However, the report highlights that China’s Tier 1.5 cities such as Tianjin, Chengdu and Shenyang, have been rapidly building office space in the hope they can transition from manufacturing based economies, to more service oriented ones. The report notes these cities on average have seen their Grade A office stock more than double every three years (to 2005, 2008, 2011 and 2014). These Tier 1.5 cities’ recent stock increases have led to concerns about oversupply. Currently about half of Tier 1.5 cities’ Grade A office space sits vacant as it is difficult to digest stock increases over a short period. Many believe the service sector in these cities, which lag behind China’s Tier 1 cities, have considerable room to expand and absorb space over the medium term.

We have reviewed leasing transactions in Tianjin this year and they reveal that indeed there has been an increase in demand from Chinese service sector firms, interestingly, many of them are from the finance sector and are often referred to as “Shadow Banks.”

Who are the Shadow Banks?

The term “shadow bank” was initially used for describing the legal structures used by big western banks in 2007 by Paul McCulley, a senior executive at PIMCO, an asset manager. Their purpose was to remove opaque and complicated securities loans off these banks’ balance sheets before the financial crisis. The term has now generally come into widespread use, referring to non-banking financial institutions, including a wide range of trusts, wealth management firms, P2P lending and internet finance firms - [1] “credit intermediation involving entities and activities (fully or partly) outside the regular banking system.” According to one study by the Brookings – Tsinghua Centre, researchers observe that unlike western countries’ financial instruments, such as securitisation, derivatives and CDOs, most shadow credit in China is straight forward lending. As the researcher said “two-thirds of shadow banking lending in China can be characterised as ‘bank loans in disguise’ that result from regulatory arbitrage;” also, the shadow banks are simply to satisfy the needs of credit from private enterprise, which cannot be met by banks. From the investor’s point of view these loans are referred to as “wealth management products” and “trusts”.

The term “shadow bank” was initially used for describing the legal structures used by big western banks in 2007 by Paul McCulley, a senior executive at PIMCO, an asset manager. Their purpose was to remove opaque and complicated securities loans off these banks’ balance sheets before the financial crisis. The term has now generally come into widespread use, referring to non-banking financial institutions, including a wide range of trusts, wealth management firms, P2P lending and internet finance firms - [1] “credit intermediation involving entities and activities (fully or partly) outside the regular banking system.” According to one study by the Brookings – Tsinghua Centre, researchers observe that unlike western countries’ financial instruments, such as securitisation, derivatives and CDOs, most shadow credit in China is straight forward lending. As the researcher said “two-thirds of shadow banking lending in China can be characterised as ‘bank loans in disguise’ that result from regulatory arbitrage;” also, the shadow banks are simply to satisfy the needs of credit from private enterprise, which cannot be met by banks. From the investor’s point of view these loans are referred to as “wealth management products” and “trusts”.

Wealth management products and trust loans emerged on a large scale in 2010 and began moving into Tier 1.5 cities from Tier 1 cities in recent years. During the period, some shadow banks began to default, bringing attention to the high risk of shadow banking operations. The Economist ’s special report in May 2014 issue gives the example of two struggling borrowers in this trust sector. Despite the risk of bankruptcy, shadow banks continued to expand at a rapid pace in Mainland China, especially as most shadow banks have not been impacted by regulations from authorities.

Why are Shadow Banks Expanding?

From an investor’s point of view, deposits in traditional banks offer measly returns given the current cap on deposit rates. For example, savings accounts yield only 0.35% annually and one-year fixed deposits earn at most 3.3%. This makes wealth management products with advertised yields of around of 10% seem very attractive to individual investors, so there are plenty of funding sources for these companies. Another reason for the emergence of shadow banks is that authorities hope this new wave of innovation will push up the service sector’s contribution to the Chinese economy. Since the weakness in manufacturing has largely dragged down economic growth, authorities hope the service sector will play a bigger role in the economy. This boom in the shadow banking sector displays the desire for service companies to evolve and play a bigger role in the economy and also an example of how the service sector is innovating in new areas.

From an investor’s point of view, deposits in traditional banks offer measly returns given the current cap on deposit rates. For example, savings accounts yield only 0.35% annually and one-year fixed deposits earn at most 3.3%. This makes wealth management products with advertised yields of around of 10% seem very attractive to individual investors, so there are plenty of funding sources for these companies. Another reason for the emergence of shadow banks is that authorities hope this new wave of innovation will push up the service sector’s contribution to the Chinese economy. Since the weakness in manufacturing has largely dragged down economic growth, authorities hope the service sector will play a bigger role in the economy. This boom in the shadow banking sector displays the desire for service companies to evolve and play a bigger role in the economy and also an example of how the service sector is innovating in new areas.

However, regulation has been tightening gradually and the shadow banks are expecting to enter a new era of consolidation. Well performing firms with diverse operations may become even larger as they acquire insolvent companies or gobble up market share from competitors. Stress in the industry and a chain of bankruptcies for weaker players might occur once regulation or competition becomes more intense.

Impact on the Real Estate Market

Not only has leasing demand from this new sector been robust, these financial institutions have illustrated a taste for top quality office projects and are willing to pay top market rents. Many of these firms are looking to quickly establish a reputation as they expand into new markets and as a result have been willing to pay high rents to acquire space in many of the best known office buildings in various Tier 1.5 cities. Landlords have been somewhat wary of these firms and have insisted on larger security deposits which again these groups are usually prepared to pay.

One obvious risk is that some shadow banks have lent to companies in financially stressed industries such as coal mining or other commodity related businesses. If these companies are unable to repay their loans in a timely manner because of short term market volatility, the shadow banks may suffer and then they may have trouble meeting their financial obligations including their rents.

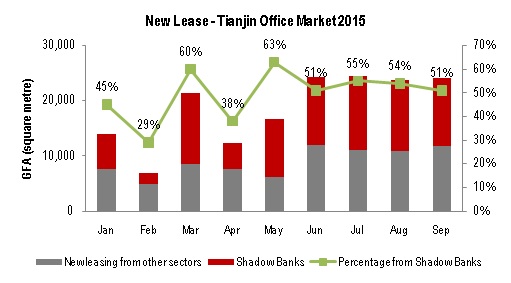

Chart 2: New lease from selected 34 office projects in Tianjin office market.

Source: JLL Research, September 2015

Chart 2 shows that in the last three months, more than 50% of new leasing transactions in Tianjin came from financial groups that could be called shadow banks.

We can expect net absorption from shadow banks may slow as the sector undergoes consolidation. Additionally, there is already some data suggesting these companies pre-terminate their leases at a higher rate than other industries. It is likely landlords will face pressure to find new better quality tenants to replace space that was previously taken up by shadow banks. Average rental values may be impacted as well. Currently, shadow banks are largely insensitive to rental rates, taking up premium space in Grade A office buildings. According to JLL transaction data, Tianjin’s shadow banks’ average rent reached CNY 5.06 per sqm per day, 10% higher than rents paid by other sectors. Overall, if the sector fails or goes under significant consolidation, we expect Tier 1.5 Grade A office buildings to see their vacancy rates and average rental values strongly impacted.

We are not suggesting there is an imminent collapse coming to the shadow banking sector, but rather, we are highlighting the emergence of a new industry thanks to financial innovation that has in a relatively short period of time become a welcome driver of office demand just as a large amount of new supply is entering the market.

In conclusion, shadow banks, which have replaced some of the lending functions of traditional banks, will eventually come under pressure from increased regulation and market consolidation. In the near term, the positive benefit of the new sector is welcomed – especially for Tier 1.5 cities that do not have as robust a tenant selection as Tier 1 cities do. However, we need to continue to watch closely as the sector may see consolidation due to newly imposed regulations and defaults among insolvent firms. Eventually however, some of these shadow banks may emerge as solid long term companies that any landlord would welcome to their property portfolio.

[1] Defined by the Financial Stability Board (FSB).

--- END ---