The Dragon Vs The Elephant

Is India Taking China's Title as the Land of Investment Opportunity?

By Michael Dow

Talk of India eventually replacing China as the shining star of the emerging market economies is nothing new. For a long time, people have been touting this enormous nation's re-emergence as a major global player in sectors ranging from manufacturing to finance. If we go by GDP figures alone, then it is easy to see why so many investors are turning bearish on China and increasingly more bullish on India. The most recent data for 2015 suggests that while the Chinese economy is still growing strongly compared to the developed world, its 6.9% growth rate was 0.4% percentage points slower than the previous year - which by China's standards is quite a substantial slowdown. Whether this is good, bad, the 'new normal' or however else commentators want to spin it, it's certainly a far cry from the incredible double-digit GDP growth of the boom years, when China was by far the brightest light in an otherwise dark financial world.

Talk of India eventually replacing China as the shining star of the emerging market economies is nothing new. For a long time, people have been touting this enormous nation's re-emergence as a major global player in sectors ranging from manufacturing to finance. If we go by GDP figures alone, then it is easy to see why so many investors are turning bearish on China and increasingly more bullish on India. The most recent data for 2015 suggests that while the Chinese economy is still growing strongly compared to the developed world, its 6.9% growth rate was 0.4% percentage points slower than the previous year - which by China's standards is quite a substantial slowdown. Whether this is good, bad, the 'new normal' or however else commentators want to spin it, it's certainly a far cry from the incredible double-digit GDP growth of the boom years, when China was by far the brightest light in an otherwise dark financial world.

Although China is undoubtedly entering a new, more turbulent phase of socioeconomic development, it doesn't mean that the opportunities for investors to are drying up altogether. There are still plenty of promising asset classes out there. However, as bullish as one naturally is on the long-term prospects of the Chinese economy, it has to be conceded that right now India is looking very attractive in comparison to its counterparts in the BRICS group of emerging market nations. Afra Afsharipour, a professor at the University of California, points out that "with most of the BRICS nations seeming to be in economical difficulty, it is India which stands out and presents the most opportunity to the world at this point in time".

The consensus amongst analysts is that Indian GDP will grow by almost 8 percent in the coming year. India Ratings & Research (Ind-Ra) said recently that they "expect the gross domestic product (GDP) to expand at 7.9 percent in 2016-17 compared with 7.4 percent in 2015-16⦠After bottoming out in 2012-13, we believe the GDP so far has followed a steady growth trajectory and is expected to do so even in the medium-term". This staggering growth trajectory looks set to persist in spite of the inevitable capital flight towards developed markets, weakening external demand and geopolitical tensions in regions to either side of the Indian subcontinent.

Certain sectors look set to do particularly well on the back of booming domestic consumption. While Ind-Ra expects the agriculture sector to grow at just 2.2 percent in 2016-17, it sees the services sector growing at 9.5 percent and most industrial sectors at 7.6 percent. The manufacturing sector looks also set to take off in the coming years as production costs in China and elsewhere make India more price competitive, and particularly if Prime Minister Modi's 'Make in India' campaign gains more traction. Given the emphasis that the country's current administration are putting on upgrading the nation's ailing infrastructure, it is reasonable to assume that construction and building materials' firms could do very well over the course of the decade. However, it remains to be seen whether India's infrastructure spending will be large enough to have a significant impact on global commodity prices like China's stimulus programmes did after the 2008 global financial crisis.

Certain sectors look set to do particularly well on the back of booming domestic consumption. While Ind-Ra expects the agriculture sector to grow at just 2.2 percent in 2016-17, it sees the services sector growing at 9.5 percent and most industrial sectors at 7.6 percent. The manufacturing sector looks also set to take off in the coming years as production costs in China and elsewhere make India more price competitive, and particularly if Prime Minister Modi's 'Make in India' campaign gains more traction. Given the emphasis that the country's current administration are putting on upgrading the nation's ailing infrastructure, it is reasonable to assume that construction and building materials' firms could do very well over the course of the decade. However, it remains to be seen whether India's infrastructure spending will be large enough to have a significant impact on global commodity prices like China's stimulus programmes did after the 2008 global financial crisis.

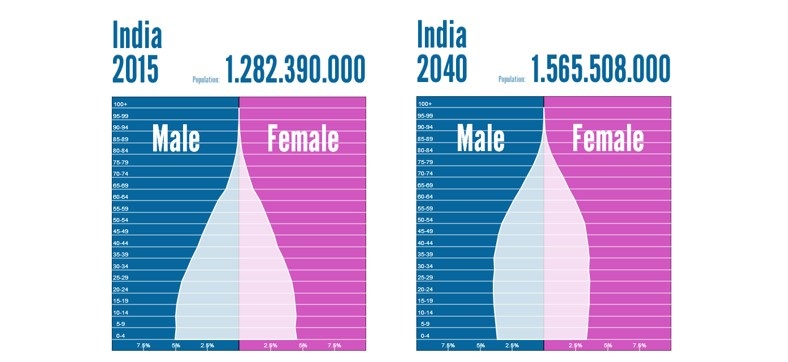

The most compelling reason for moving investment capital from China and elsewhere to India is its demographic advantages. While China and other Asian superstar economies of yesteryear have rapidly aging populations, India is in a very favourable demographic situation with regards to fuelling a big growth spurt. Forbes contributor Michael Lingenheld says that "India is expected to benefit from a "demographic dividend" for years to come. The country will soon have 20% of the world's working-age population, and boasts a birth rate of 2.5 children per woman". Moreover, he notes that "the working-age population, aged 15-64, will rise by 125 million over the next decade, and another 103 million over the following decade. India probably needs to create 100 million net new jobs over the next 10 years just to keep pace with its explosive population growth". Other demographic factors - such as gender balance - will also work in the country's favour over the coming years.

On the flip side, when equipped with these kinds of figures, it is easy to get carried away with expectations of rapid GDP growth. It is worth remembering that for all its upsides the Indian economy and society as a whole is still plagued by some very big and tricky ailments. Perhaps the biggest one of all is rampant inefficiency. In a recent interview, the governor of the Reserve Bank of India (RBI), Rughuram Rajan, summed it up pretty well when he said the three things the nation needs more than anything to improve its economy are "implementation, implementation and implementation". He went on to say that "if our implementation matches our promise, I have no doubt that in the next five or 10 years this will be the place to be. But the gap in India has always been between promise and execution".

In addition to all the dithering, corruption, nepotism and deep-seated division based on cultural identities amongst the political elite, India still has a very long way to go in fostering the levels of human capital and equality of opportunity that it will need to become a more advanced economy. Like many of their counterparts in other emerging economies, India's leaders also have much more to do to make their country a more competitive destination for foreign capital and better integrate themselves within the global financial community. In almost every one of these areas it is fair to say that China is still well out in front of them.

In addition to all the dithering, corruption, nepotism and deep-seated division based on cultural identities amongst the political elite, India still has a very long way to go in fostering the levels of human capital and equality of opportunity that it will need to become a more advanced economy. Like many of their counterparts in other emerging economies, India's leaders also have much more to do to make their country a more competitive destination for foreign capital and better integrate themselves within the global financial community. In almost every one of these areas it is fair to say that China is still well out in front of them.

So is it time to put more of your money behind Asia's new emerging giant? It definitely is, but that doesn't mean we should neglect the other regional economies whose growth stories may not be as exciting but whose long-term prospects, for now at least, still look pretty good by comparison.

--END--