Will China's Debt Bubble Burst or Continue To Rise?

By Harold Murphy

本期的深度观察我们将聚焦中国债务情况。我国政府债务近年来不断增长,截至2016年3月,政府和国家机构的债务总额约为4.3万亿美元,相当于中国GDP总量的41%左右。而2016年美国公共债务占国内生产总值的占比为104%,虽然美国债务所占GDP比率明显高出更多,但是债务结构有很大的不同。

本期的深度观察我们将聚焦中国债务情况。我国政府债务近年来不断增长,截至2016年3月,政府和国家机构的债务总额约为4.3万亿美元,相当于中国GDP总量的41%左右。而2016年美国公共债务占国内生产总值的占比为104%,虽然美国债务所占GDP比率明显高出更多,但是债务结构有很大的不同。

资料显示,我国国债的30%与外债有关。其中美元占80%,欧元6%,日元4%。中央与各地方政府及企业的负担部分也并不均衡。美国2/3的公共债务由美联储和美国公民与实体拥有,而美国的外债主要由中国与日本持有。在这方面,日本比率更低,只有不到5%是由外国持有的。另一方面,数据显示中国家庭的债务占家庭总资产比率最低,截止2016年,该比率仅为9%。

中国财政部部长肖捷表示,中国在调整预算赤字比例方面仍然具有灵活度,政府计划根据经济増长率增加政府支出,同时偿还债务。"中国经济与财政收入的增长是偿还债务的基础"。今年政府将减税并加大公共投资力度,增加的赤字部分将由经济增长部分弥补。

除了政府负债这一问题外,高度负债企业也可能成为中国的主要问题。许多国有企业从政府主导的银行大量贷款,所以一旦这些企业出现问题,中国金融体系也将会有连锁反应。企业应更多转向资本市场来融资。

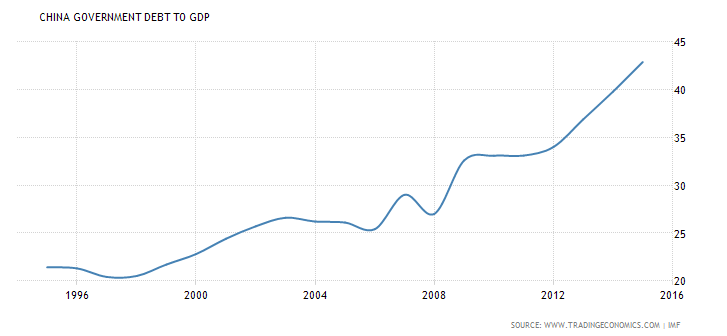

The government debt of China is reaching an unprecedented level. The total amount owed by the government and state organizations stands at approximately US$ 4.3 trillion, as of March 2016. This is an equivalent of about 41% of the Chinese GDP.

For comparison, public debt-to-GDP ratio in the United States was 104% in 2016, and 243% in Japan for the year 2013. These countries do have a larger public debt-to-GDP ratio than China, but the overall structure of the debt is very different.

According to data from the country's State Administration of Foreign Exchange, around 30% of that sum, or US$ 1.7 trillion, was related to the foreign debt of China. The denomination of the foreign debt is 80% in US$, 6% in euros and 4% in Japanese yen. The burden is also unevenly distributed between the central and local governments, and the corporate sector. The total outstanding debt of the corporate sector alone was equal to 168% of economic output, according to Bloomberg's estimates.

Regarding the debt-ownership of other developed countries, approximately two thirds of US public debt is owned by the Federal Reserve and US citizens and entities, while the US foreign debt is held mostly by China and Japan. Conversely, less than 5% of Japanese public debt is held by foreign countries.

When compared to other developing countries, the dynamics of the debt increase is very similar to Russia, which still has a far lower debt-to-GDP ratio than China, of around 18% of GDP as of 2015. The debt of India remained mostly unchanged, ranging from 68% to 69% of GDP in the last 5 years.

On the other hand, Chinese households have the lowest ratio of debt to wealth of any major economy in the world. It totals only 9% as of mid-2016, compared to roughly 25% for some developed countries like Australia and Switzerland.

Many analysts are concerned over the overall size of the government debt, but Chinese authorities have dismissed analyst's worries, stating that "the country still has room to increase government debt."

For 2017, the Chinese government expects the economy to grow by around 6.5 percent; compared to a 6.7 percent expansion in 2016, which was the slowest growth in 26 years. Chinese officials are still trying to drive economic growth by large investment projects in infrastructure, airports and commercial real estate, which are partly financed by huge amounts of loans provided by commercial banks.

The IMF in its "World Economic Outlook Database" forecasted a future rise in the government debt by around 3% annually, totaling to almost 59% of the overall GDP by year 2022. The complete outlook is presented in the following table.

Another concern is China's fiscal income, which accounts for around 30% of GDP. "This is relatively low compared with other countries, and far lower than that in developed countries.", said former finance minister Lou Jiwei.

Former China's finance minister Lou Jiwei was succeeded by Xiao Jie in November 2016, who had previously served as vice secretary-general of the State Council.

Xiao Jie, said that China still has some flexibility to adjust the budget deficit ratio. The government's plan is to increase government spending in line with the growth rate of the economy, while also paying off debt. "A growing Chinese economy and fiscal income are the fundamental supports to repay debts," he said. The budget deficit plan for 2017 stands at 3% of GDP; the same as last year and an increase compared to 2.4% for 2015.

Budget deficit in China averaged -2.03% of GDP from 1988 until 2016, reaching an all-time high of 0.58% of GDP in 2007.

In this year, China plans to fund tax reduction and public investments, and any rise in budget deficit is planned to be covered by the increase in economy output.

Other plans that the government has is a tax reform plan, particularly some household spending items may be excluded from the individual income tax, and the country will give tax breaks of about $5 billion to companies this year. Regarding local governments, they will continue to sell general and special bonds this year, according to Xiao Jie.

Beside the amount of the government debt, the corporate sector might also be risky. David Lipton, first deputy managing director with the International Monetary Fund, emphasized that China's corporate borrowing is a major concern, warning addressing the issue is "imperative to avoid serious problems down the road".

The highly indebted corporate sector could also become a major problem in China. With a total debt of 250% of GDP, a derail of state-owned banks could trigger a systematic crisis. Especially the debt linkages between the government and real sector is of increasing concern.

Although the overall debt-to-GDP ratio is not the highest in the world, the special relationship between state-owned companies and banks could ultimately create a deep crisis. The non-financial corporate sector is of special concern, with a estimated debt-to-GDP ratio of 156%.

"The gravity of China's non-financial corporate debt is that if problems occur with it, China's financial system will have problems immediately," said Li Yang, a senior researcher with the leading government think-tank the China Academy of Social Sciences (CASS).

Many state-owned firms borrowed heavily from government-backed banks, and any problem in this sector could create systematic risks. "It's a fatal issue in China. Because of such a link, it is probably more urgent for China than other countries to resolve the debt problem," he said.

Chinese businesses should count on a likely squeeze in credit availability to the private sector. Instead of cheap loans available today, companies may finance their growth by turning to capital markets, and should take into account a possible liquidity crisis or a drop in economic activity.

--- END ---