The Democratization of Finance

Cheaper Alternatives to Banks

By Harold Murphy

从实体银行到网上银行,再从网上银行到支付软件,金融领域随着网络科技的发展发生了巨大的变化,消费者也收获了更多实惠的交易选择。2015年,三分之二的人从未使用“金融科技”服务进行国际支付、贷款、店内付款等服务。到2020年,大约一半的消费者可能会使用金融科技公司的服务进行至少一项服务,而三分之一的消费者希望将其用于50%以上的经济活动。正如今天我们出门可以只带装有支付宝或微信APP的手机而可以不带钱包一样。在国际市场上,除了我们熟知的PayPal,还有TransferWise,Zopa,Prosper,BillFloat,Kickstarter,Indiegogo等成熟的在线金融服务商,它们也正吸引着越来越多的客户。

从实体银行到网上银行,再从网上银行到支付软件,金融领域随着网络科技的发展发生了巨大的变化,消费者也收获了更多实惠的交易选择。2015年,三分之二的人从未使用“金融科技”服务进行国际支付、贷款、店内付款等服务。到2020年,大约一半的消费者可能会使用金融科技公司的服务进行至少一项服务,而三分之一的消费者希望将其用于50%以上的经济活动。正如今天我们出门可以只带装有支付宝或微信APP的手机而可以不带钱包一样。在国际市场上,除了我们熟知的PayPal,还有TransferWise,Zopa,Prosper,BillFloat,Kickstarter,Indiegogo等成熟的在线金融服务商,它们也正吸引着越来越多的客户。

从业务领域看,目前对金融市场影响较大的金融科技领域主要包括四个类别:支付清算,电子货币以及区块链技术都可归入第一类别;直接或间接融资,P2P、众筹为第二类别;第三类别是市场基础设施,包括大数据、云计算、电子身份认证、电子聚合器(E-Aggregators)、智慧合同(Smart Contracts)等;第四类别是投资管理功能类,包括机器人投资顾问、固息收益市场的电子自动交易等。这一切都可用来提高金融服务效率。

金融科技公司通过提供比传统银行更低的利率和更快的处理时间,获得了越来越多的市场份额。另外,众筹和贷款等服务也逐渐加入到了金融科技领域,由此可以看出金融科技公司提供的产品之丰富。当然了,如果想有更长远的发展,只做银行的在线替代品是不够的,还需要满足市场更广泛的金融业务需求。

How Technology is Changing the World of Finance

How Technology is Changing the World of Finance

The Fourth industrial revolution is slowly crawling into the financial sector. Technology is creating an environment where money becomes cheaper and more accessible to ordinary people. More and more banks shifted to online banking and now to mobile banking to offer better customer experience, but banks are still charging fees that customers can’t avoid paying – until now.

The emergence of alternatives to banks, or alternative finance, backed by technological development in the last decade, is about to alter the way we look at financial services. In many areas, banks are losing their monopolistic position as cheaper alternatives provided by newcomers are grabbing a growing market share.

According to a report by World Bank, customers have already saved more than $60 billion since 2010 by using alternative ways for sending international payments and avoiding traditional bank services.

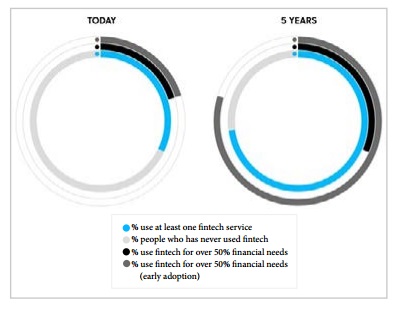

As the graphic above shows, in 2015 two-thirds of people had never used a fintech service as a replacement for banks for services like international payments, lending, in-store payments and other. By 2020, around half the consumers may use a fintech company for at least one service, while a third of consumers expect to use it for more than 50% of their financial needs.

As the graphic above shows, in 2015 two-thirds of people had never used a fintech service as a replacement for banks for services like international payments, lending, in-store payments and other. By 2020, around half the consumers may use a fintech company for at least one service, while a third of consumers expect to use it for more than 50% of their financial needs.

Emergence of Bank Alternatives

Alternative finance may change the way we use and look at financial services in the near future. There are already numerous fintech (Financial Technology) companies offering financial services faster, with more convenience and at a lower cost compare to traditional banks. Companies like TransferWise, Zopa, Prosper, BillFloat, Kickstarter, Indiegogo, and more established online providers like PayPal are attracting a growing number of customers who want to benefit from the ongoing financial revolution.

Alternative finance may change the way we use and look at financial services in the near future. There are already numerous fintech (Financial Technology) companies offering financial services faster, with more convenience and at a lower cost compare to traditional banks. Companies like TransferWise, Zopa, Prosper, BillFloat, Kickstarter, Indiegogo, and more established online providers like PayPal are attracting a growing number of customers who want to benefit from the ongoing financial revolution.

These companies are rapidly earning one of the most important pillars in the financial industry - trust. Their success formula includes simplicity in user experience and accessibility and the 2017 Edleman Trust Barometer concludes that peers are now seen as having an equal level of credibility as experts.

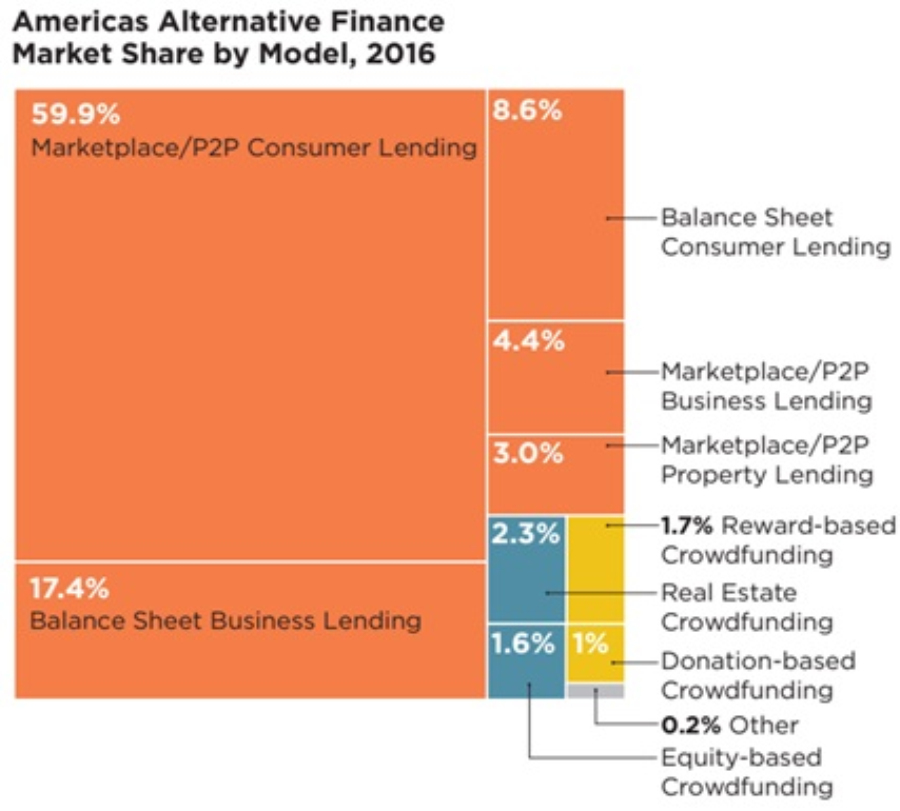

In terms of volume, alternative finance is growing worldwide but the main hub remains the United States. Approximately $19 billion of the US alternative finance volume is provided by institutional investors, up from $17 billion in 2015.

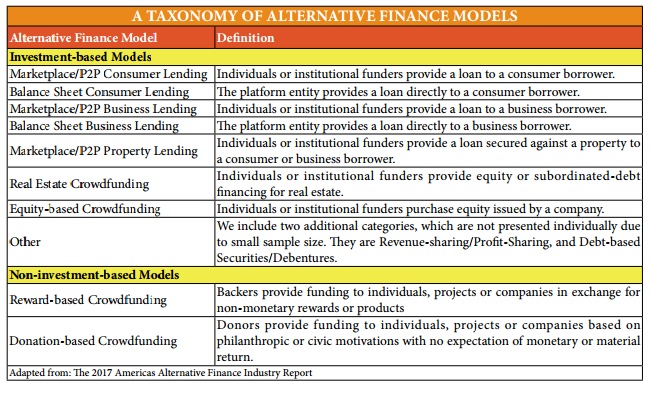

Alternative finance counts a number of different models which can be divided into investment-based models and non-investment based models. The following table shows the variety of models currently in existence with the definition for each.

Crowdfunding

Crowdfunding

Crowdfunding is shifting the source of capital from established finance institutions to the crowd. It gives ordinary people the same opportunities that previously were available only to banks and large investors.

Crowdfunding sites replace the middleman (i.e. the bank) and provide a cheaper source of capital to growing businesses faster and in a more efficient manner as compared with a bank. There are two main models of these platforms: debt-based model, and equity-based model.

Debt-based platforms are similar to traditional lending services offered by banks. They offer people the opportunity to lend money to promising start-ups and growing businesses that are usually considered as too risky by banks.

On the other side, equity-based platforms relate to start-ups and companies in their early stage that offer equity to the company in exchange for money. These types of platforms offer companies the opportunity to raise capital faster and without taping into capital markets. IPOs and services of investment banks are usually costly and time-consuming undertakings, and many start-ups and growing companies are avoiding this hassle by using equity-based crowdfunding services.

P2P Platforms for Personal Loans

P2P Platforms for Personal Loans

Online P2P platforms also offer personal loans for a variety of purposes (also called an “all-purpose loan”) at a fraction of cost and time as compared to traditional banks. For many people in developing economies, personal loans are an important source of short-term liquidity. By directly connecting borrowers and lenders, these platforms are able to reduce the cost (interest rates) and processing time considerably, as well as reduce operation costs that banks have to charge.

P2P consumer lending has by far the largest market share in the US among all the alternative finance models, according to the 2017 Americas Alternative Finance Industry Report.

Sites like Zopa.com and Lending Club are among the big players in the area of P2P personal loans. The California-based Lending Club, world’s biggest peer-to-peer lending company, has hit a valuation of $5.4 billion in its IPO in December 2014. Another popular lending site, Prosper.com, also offers lower interest rates on loans with no prepayment penalties compared to traditional banks.

Sites like Zopa.com and Lending Club are among the big players in the area of P2P personal loans. The California-based Lending Club, world’s biggest peer-to-peer lending company, has hit a valuation of $5.4 billion in its IPO in December 2014. Another popular lending site, Prosper.com, also offers lower interest rates on loans with no prepayment penalties compared to traditional banks.

Bank Alternatives to International Payments

Banks have the tendency to charge higher fees to boost their profits. A resident of the United States pays on an average $10 to $40 on monthly fees to his bank, and a large share is taken from international payments with an average cost of above 7% per transaction size. By using online providers like PayPal, customers can reduce the cost of making international payments significantly. For US customers, PayPal charges a 4.4% transaction fee plus a small fixed fee depending on currency received for international sales, while fees for sending money to friends and family members are usually in the 0.5-1.0% range for most countries.

Cryptocurrencies and International Payments

Cryptocurrencies and International Payments

Another interesting alternative for international payments are digital currencies. Bitcoin, the largest of the digital currencies by market cap, is also used for making worldwide peer-to-peer payments, usually without or significantly lower transaction costs compared to traditional channels of international payments. Bitcoin is accepted by an increasing number of digital and physical stores and online sites like Wordpress.com, Microsoft, Virgin Galactic, Dell and others, and bitcoin-ATMs located in major cities around the world give this cryptocurrency an obvious advantage over other digital currencies. However, bitcoin has still a long way to go to be truly globally accepted and its price volatility is much larger as compared to traditional currencies.

Summary

Summary

Technological development is changing the way customers perceive and use financial services which once were dominated by banks. FinTech is an evolving field with incredible opportunities in the near future. By offering lower interest rates and faster processing times than traditional banks, alternative finance offers opportunities to people worldwide and takes an increasing market share from traditional players. However, FinTech companies should be considered as subjects which enrich the banking and finance experience, rather than as a substitute to big banks, as traditional financial institutions turn more and more to financial technology themselves.

--- END ---