Trade Surplus Shrinks Slightly

By Morgan Brandy

据我国5月份经济数据显示,各经济指标继续保持稳定增长。5月份的采购经理人指数有所提升,达到了52.9(50以上表示指数提升,而低于该阈值表明指数萎缩)。受商品价格上涨推动,生产者物价指数在5月份连续第二个月出现增长,同比上涨了4.1%。 5月份原材料价格较往年同期上涨7.4%,而4月份则仅上涨5.7%。消费者价格指数也保持了稳定增长——5月份消费者价格指数为1.8%,与4月份相同。5月我国进出口额均高于预期。进口增加使中国的贸易顺差从1828亿人民币缩减至1565.1亿人民币。在出口方面,尽管5月出口额较往年同期相比增长了3.2%,但比上月的3.7%有所下降,随着贸易局势紧张,中国与美国的贸易顺差增至245.8亿美元,而4月份则为221.5亿美元。

据我国5月份经济数据显示,各经济指标继续保持稳定增长。5月份的采购经理人指数有所提升,达到了52.9(50以上表示指数提升,而低于该阈值表明指数萎缩)。受商品价格上涨推动,生产者物价指数在5月份连续第二个月出现增长,同比上涨了4.1%。 5月份原材料价格较往年同期上涨7.4%,而4月份则仅上涨5.7%。消费者价格指数也保持了稳定增长——5月份消费者价格指数为1.8%,与4月份相同。5月我国进出口额均高于预期。进口增加使中国的贸易顺差从1828亿人民币缩减至1565.1亿人民币。在出口方面,尽管5月出口额较往年同期相比增长了3.2%,但比上月的3.7%有所下降,随着贸易局势紧张,中国与美国的贸易顺差增至245.8亿美元,而4月份则为221.5亿美元。

进口额增长的驱动因素之一是电脑芯片和大宗商品(包括农业原油,铜矿,精矿和天然气)的进口量增加。此外,为了向美方发出积极信号,我国政府增加了从美国进口的石油货运量。

各行业发展愈加活跃使大家对未来几个月经济前景更加看好,就业岗位也相应增加。服务业规模的扩大带来了更多岗位,而在制造业方面,机器正在一步步取代人工劳动力。

截至目前,我国第二季度的各项数据表现良好,尽管挑战依然存在,GDP仍将保持稳定增长,进出口贸易相较平衡。

Chinese economic data for the month of May shows that growth continues to be under way at a steady rate. Growth in many sectors remained healthy, and prices in the economy maintained their upward movement. Although the growth rate in some areas may be very slightly decelerating, this does not change the current growth trajectory.

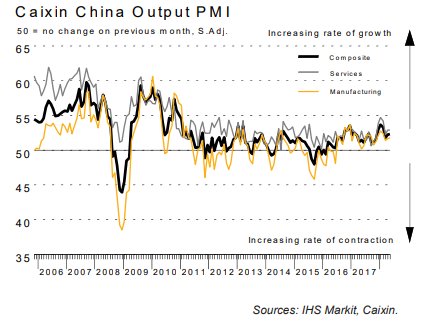

Caixin China Services PMI

The ‘purchasing manager’ index of the service sector has indicated that it has expanded during the month of May. The Caixin services PMI printed a reading of 52.9 in May, which is equal to April reading (readings above 50 indicate expansion whereas readings below that threshold indicate contraction). Driver of this growth in the industrial and non-industrial activity was the increased hiring due to bright outlook on economic conditions during the upcoming months.

Despite growth, reports showed that companies were having slower new orders, and their ability to impose prices on the market was weakened by intense competition. Input costs were higher as well due to higher wages and higher transport costs.

Despite growth, reports showed that companies were having slower new orders, and their ability to impose prices on the market was weakened by intense competition. Input costs were higher as well due to higher wages and higher transport costs.

Services sector is important to economic growth as it is relied upon for generating jobs at a time when in the manufacturing sector machines are slowly but steadily replacing workers. The Caixin services PMI report showed that companies hired at the fastest rate in May since January. At the same time, the new-businesses component of the index decreased slightly to 52.2 from 53 in April (which shows a deceleration rather than a contraction).

A more inclusive index which covers both the services and the manufacturing sector also showed an expansion with a reading of 52.3 in May.

Price Indices

As for inflation in the economy, producer prices recorded a growth for the second month in a row in May, driven by higher commodity prices. Prices of raw materials registered a high increase of 7.4% in May on an annual basis, compared with a growth of 5.7% on an annual basis on April.

The producer price index (PPI) showed an increase of 4.1% in May on a year on year basis, as compared with an increase of 3.4% in April, according to the National Bureau of Statistics (NBS).

The producer price index (PPI) showed an increase of 4.1% in May on a year on year basis, as compared with an increase of 3.4% in April, according to the National Bureau of Statistics (NBS).

Consumer prices, on the other hand, maintained their steady growth, as the consumer price index showed a reading of 1.8% growth in May, the same rate of growth registered in April, as food prices were stable for the most part of last month.

Even core consumer price index, which excludes prices of volatile food items and energy prices, recorded an increase of 1.9% in May, as compared to 2% growth in April. Thus, overall, growth in prices of consumer goods remained on course.

The high inflation figures gave further confidence about the growth trajectory, especially amid concerns like regulatory tightening on credit, stricter controls on pollution (air, water, and soil), and the trade spat with the United States. The numbers showed that inflation growth could offset the effects of those factors. In addition, higher prices could benefit Chinese industrial companies in terms of higher earnings. Profits of Chinese companies were growing at the highest rate in April in six months. Earnings of steel and iron processing companies, in particular, saw a growth of 260 percent in the same period.

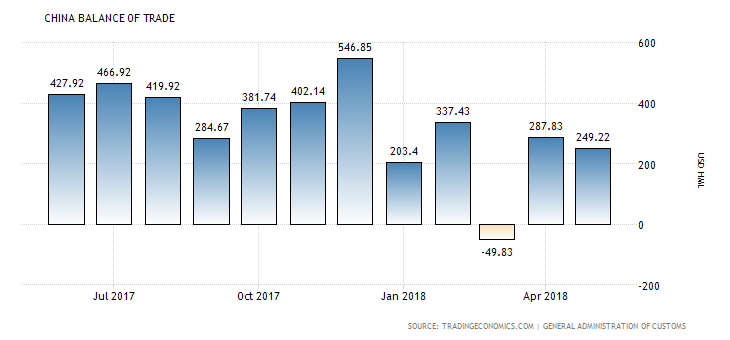

Trade balance in May

China’s exports and imports were both higher than expected in May. The increase in imports caused China’s trade surplus to shrink to CYN 156.51 billion (or $24.92 billion) from CYN 182.80 billion (or US$28.38 billion).

China’s exports and imports were both higher than expected in May. The increase in imports caused China’s trade surplus to shrink to CYN 156.51 billion (or $24.92 billion) from CYN 182.80 billion (or US$28.38 billion).

While exports showed a growth of 3.2% on yearly basis in May, this was a slower rate than 3.7% recorded in the previous period, albeit better than expectations at 1.7%. In US dollar terms, exports grew at 12.6% as compared with 12.7% in the previous period, whereas imports increased by 26% as compared with 21.5% previously. And following trade tensions and the deal with the US, China’s trade surplus with America increased to $24.58 billion, as compared with $22.15 billion surplus in April.

One driver of higher imports was the increased inbound shipments of computer chips and commodities including agricultural crude oil, copper ore and concentrate and natural gas. Moreover, to offer a positive intention to Washington, the Chinese government increased its oil imports from the US, as it ordered public refineries to purchase more from America. Imports from Australia also increased at a rate of 22.4% after declining by 3.1% in April.

Conclusion

Up to this point, the data about the second quarter is positive, although it shows the same or lower rates of expansion than previous periods. The positive data indicates that GDP growth will remain steady, despite the current challenges. Economic conditions elsewhere could have caused China’s export to decline slightly and imports to increase, but China maintains a good surplus. And as the world’s largest exporting country, its trade balance remains healthy.

Consumer prices may come under more pressure if trade tensions intensify between the United States and China, with agricultural products being the most vulnerable. But the tight credit regulations and cooling property market could limit that effect. Furthermore, inflation figures remain below target of Chinese government at 3% in 2018. Overall, May remained a positive month for the economy, but uncertainty regarding foreign trade abounds.