New Draft of Foreign Investment Law

By Manuel Torres, Managing Partner of Garrigues China & Dun Zhang, Senior Associate

外国投资法新草案

外国投资法新草案

2018年12月26日,中国全国人民代表大会发布了外国投资法草案,征求公众意见。在其他变化中,我们想强调新草案中的以下新发展:

1.外国投资的新定义

根据新草案,“外国投资”是指外国投资者在新项目,或增加在中国大陆的投资,或收购股份,股权,财产股, 或中国内地企业通过兼并或收购的其他类似权益。 与此同时,新草案还授权国务院进一步表明其他形式的外国投资。

2. 促进和保护外国投资

新草案强调了在中国经营的外国投资者的平等待遇,并禁止行政当局或其官员要求的强制性技术转让。它还表明,地方政府必须信守外国投资者的承诺,并依法尊重与外国投资者的投资协议。

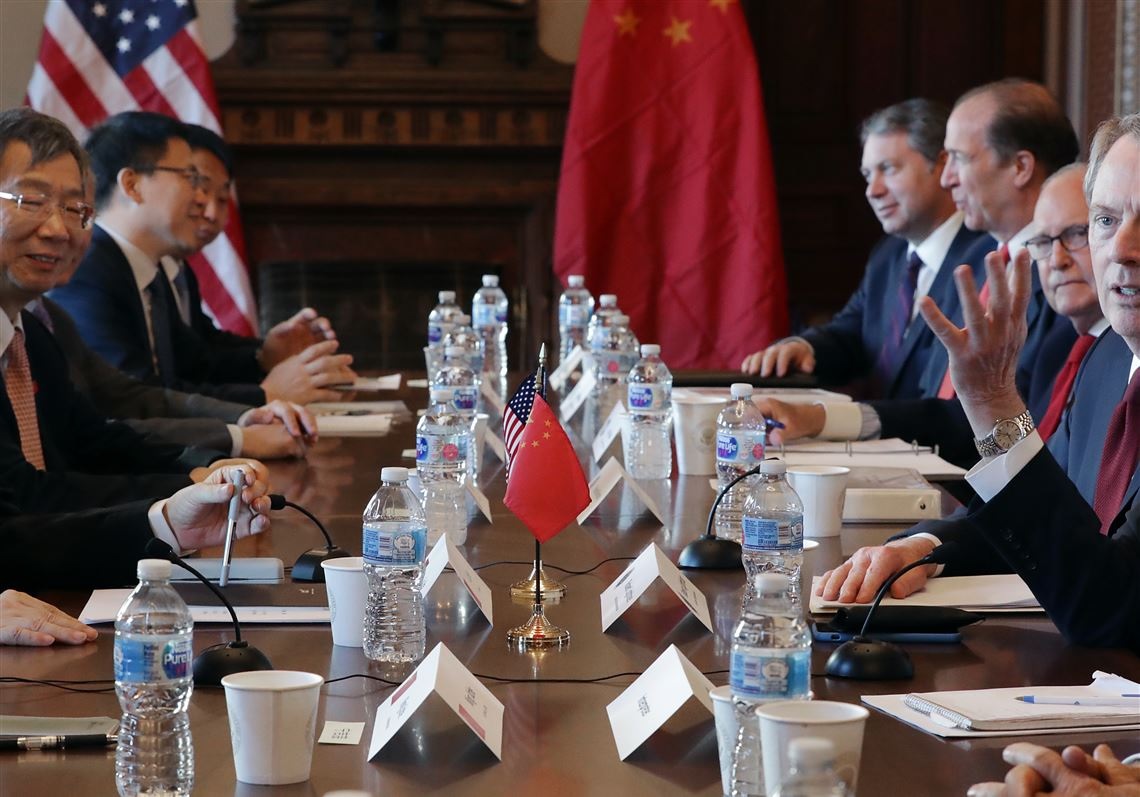

On December 26th, 2018, the National People’s Congress (“NPC”) of China published the draft Foreign Investment Law (“New Draft”), seeking for public opinions. This draft is considered as an updated version based on a draft made by China’s Ministry of Commerce, which was published four years ago (“MOFCOM Draft”) .

On December 26th, 2018, the National People’s Congress (“NPC”) of China published the draft Foreign Investment Law (“New Draft”), seeking for public opinions. This draft is considered as an updated version based on a draft made by China’s Ministry of Commerce, which was published four years ago (“MOFCOM Draft”) .

Notably, comparing to the MOFCOM Draft, the scale of the New Draft shrinks significantly from 170 articles to 39 articles, with certain aspects removed from the scope of the law, and various detailed implementation rules replaced by more generic articles.

Among other changes, we would like to highlight the following new developments in the New Draft:

1. New Definition of Foreign Investment

1. New Definition of Foreign Investment

Pursuant to the New Draft, the “foreign investment” refers to the investment activities of foreign investors in new projects, establishment of foreign-invested enterprises, or increase of investment in mainland China, or acquisition of stock shares, stock equity, property shares or other similar rights and interests in mainland Chinese enterprises through mergers or acquisitions. In the meantime, the New Draft also authorizes the State Council to further indicate other forms of foreign investment.

Comparing to the MOFCOM Draft, which implies that contractual control over the Chinese enterprises by foreign investor would also constitute “foreign investment”, the New Draft has taken a more conservative attitude towards this controversial issue. This may reflect the ambivalence of the Chinese legislators over the widely used “VIE” structure, which features the contractual control of the onshore companies by offshore special purpose vehicles (“SPVs”). This kind of contractual control structure has been applied so that the Chinese companies may receive foreign funding (mainly by getting their controlling offshore SPVs listed at foreign stock markets) while still keeping their legal status as domestic companies, so as to maintain the legal qualifications for the operation in the foreign investment restricted/prohibited areas.

Having said so, taking into account the recent challenge from the Chinese government on the VIE structure in specific area (i.e. pre-school education services ), it is not clear what will be the final resolution of the Chinese government on this issue.

2. Promotion and Protection of Foreign Investment

2. Promotion and Protection of Foreign Investment

The New Draft highlights equal treatments of foreign investors operating in China, and bans mandatory technology transfers requested by administrative authorities or their officials. It also indicates that local governments are required to keep their promises to the foreign investors, and honour the investment agreements with the foreign investors according to the laws.

3. Foreign Investment Administrative Systems

The New Draft affirms that the State implements the management scheme of pre-establishment national treatment plus negative list. Since the relevant detailed rules of those administrative systems have already been covered by administrative regulations previously published by the State Council, the New Draft does not go into further details.

4. Five-Year Transition Period

4. Five-Year Transition Period

Same as MOFCOM Draft, the New Draft also aims to transform the current administration system of foreign investment and to replace the three existing laws on joint ventures and wholly foreign-owned enterprises. The joint ventures and wholly foreign-owned enterprises established so far, based on the three existing laws, will be given a five-year transition period to perform necessary changes on their corporate forms in order to be compliance with the laws applicable at that time (which will be mainly the Company Law of the PRC).

Comparing to the MOFCOM Draft, which provided a three-year transition period, the New Draft has provided two additional years for the foreign invested companies to make adaptations to the then applicable laws.

By emphasizing the principles of protecting foreign investments while keeping silent on the controversial topics, the new draft of Foreign Investment Law sends out the positive messages that China intends to pacify the foreign investors, by making assurances and addressing some of their major concerns. As it may take a few more years for the Foreign Investment Law to be formally enacted, it is advisable for the investors to keep track on the future development of this new law.