CHINA GDP GROWTH IN 2018 REACHED 6.6%

The Lowest in 28 years

By Morgan Brady

2018年中国GDP增长6.6%

2018年中国GDP增长6.6%

创28年新低

国家统计局数据显示,2018年中国国内生产总值(GDP)增长6.6%,这是28年来(1990年)的最低增长率。第四季度增长率为6.4%,第三季度增长率为6.5%。年增长率略高于预期的6.5%。

根据1月的数据,2019年开局强劲

中国在2019年开局强劲。1月份,以美元计价的出口较上年同期增长9.1%,而预测仅为3.2%。另一方面,1月份进口较上年同期下降1.5%,也高于预期的10%。据路透社调查显示,根据这些数据,中国的贸易顺差也超出预期,达到391.6亿美元,高于预期的335亿美元。这在12月份出现下滑后变为好消息。

与美国交易数据

在与美国的贸易量方面,对美国的出口和从美国的进口均下降。出口较上年同期下降2.4%,进口下降41.2%。一些分析师认为,出口量有下降趋势。

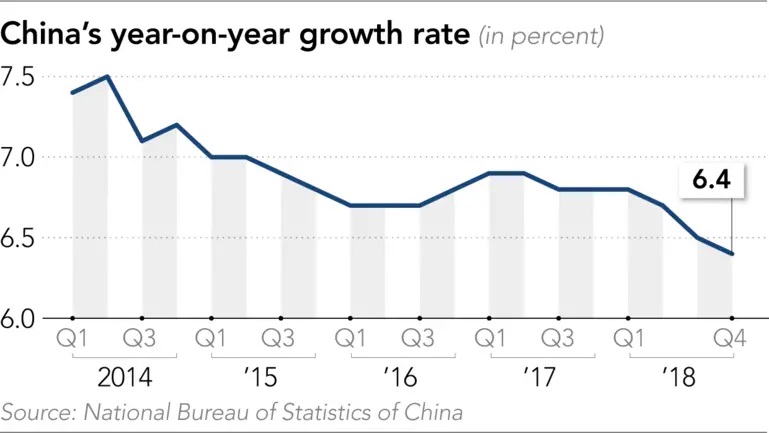

The economic performance numbers for 2018 have been concluded, as they were released late in January. The Chinese economy grew by 6.6% in 2018, according to Beijing’s statistics, which is the slowest rate in 28 years (1990). This number, however, remains better that western growth rates, mostly below 4.5% at the best. The fourth quarter growth was at 6.4% and in the third quarter, it was 6.5%. The annual growth rate was slightly better than expectations at 6.5%, but economists are worried.

The economic performance numbers for 2018 have been concluded, as they were released late in January. The Chinese economy grew by 6.6% in 2018, according to Beijing’s statistics, which is the slowest rate in 28 years (1990). This number, however, remains better that western growth rates, mostly below 4.5% at the best. The fourth quarter growth was at 6.4% and in the third quarter, it was 6.5%. The annual growth rate was slightly better than expectations at 6.5%, but economists are worried.

A strong start in 2019 based on January figures

China showed a strong start in 2019. In January, Exports denominated in US dollar grew by 9.1 percent from a year earlier, against pessimistic forecasts of 3.2 percent contraction. Imports in January, on the other hand, declined by 1.5 percent from a year earlier, which is also better than the expected decline of 10 percent. With those figures, China’s trade surplus also beat expectations and showed a reading of $39.16 billion, higher than the expected $33.5 billion according to a poll by Reuters. This comes as good news after the decline seen in December.

Trade data with the US

Trade data with the US

In regard to trade volume with the US, both exports to the US and imports from it fell. Exports fell by 2.4% from a year earlier, and imports plummeted by 41.2%. China’s trade surplus with the US fell from $29.87 to $27.3 billion. Some analysts were not very optimistic despite the numbers and wanted to wait for more data. They wanted to ensure that the effects of the Lunar year holiday fall in different dates on the Gregorian calendar each year, and the seasonal cycles wear off. Some analysts believe that the trend in shipments is heading in a downward direction.

Many manufacturers have moved their production factories outside of China, which gave a boost to Chinese exports to ASEAN and the EU, based on the orders from those regions. Exports to the European Union increased by 14.5% in January from a year earlier, while exports to ASEAN increased by 11.5%. This helps to counter the effects of declining exports to the US.

Growing consumer market

Growing consumer market

It is worth noting that the reliance on exports to the US, as a growth driver, is weakening in China. This is because the Chinese consumer market is growing faster than other countries, to the extent that this market was behind four fifths of GDP growth in 2018. This indicates that the Chinese economy has a strong cushion against shocks from its trade partners, although developments in domestic demand in 2019 are still uncertain.

Tariffs are not the only element in the trade spat

In any scenario, the government is taking measures to stimulate the economy, such as tax cuts and export rebates. However, those measures need to be supplemented by adaptive measures from businesses. The trade relations with the US are not certain and this may lead to market volatility, which can impact investor sentiment. Backward and forward links of businesses in their supply chain may need to be shifted quickly. Tariffs are one element in a larger mix that imposes limitations on Chinese businesses in their relations with the US. This mix includes also the inability of Chinese businesses to acquire companies in the US or transfer intellectual property from the US to China. Those other restrictions may have similar adverse effects on Chinese businesses, but the tariffs are the media’s main focus.

Manufacturers taking their operations abroad

Manufacturers taking their operations abroad

We are already seeing signs of adaptive business activity. Companies are moving their activities abroad. Samsung, Panasonic, and TCL have taken their operations to other countries to avoid being hit by the tariffs. This reflects negatively on job opportunities and employment, as well as income. But while this may seem like a negative development for China, it needs to be looked at from another angle. Chinese companies can operate from abroad depending on their flexibility to be able to export to the US. Production swapping agreements between different factories, to enable factories outside of China to export to the US, are also a viable option that does not come with capital investment costs, although they can come with an operational cost.

Conclusion

Despite the good trade performance, the year ahead remains wrought with uncertainty. Chinese and the US officials are trying to make a deal before the deadline on the 1st of March, before tariffs increase from 10% to 25% on Chinese products worth $200 billion. With prices in the US increasing, and having one million jobs being lost as a result of the trade war, officials from both countries have an impetus to reach a resolution, albeit not guaranteed. The trade war truce previously agreed upon is ending soon. What is next is yet to be seen.