Striking back against the outbreak of COVID-19

A series of fiscal and taxation policies to prevent and control the epidemic were released

ãé²ç«åºåã

è´¢ç¨é¨é¨éç£

ååï¼èç¦ç«æ

é²æ§

By Kelvin Lee, PwC

In response to the severe epidemic situation of the novel coronavirus pneumonia (COVID-19), Chinese governments at all levels rapidly issued several policies to control the epidemic and support the economy. On February 5, the executive meeting of the State Council decided to launch a series of fiscal and taxation policies in addition to the previously introduced measures, to ensure that there are sufficient supplies for the epidemic prevention and control work, effective from 1 January 2020.

In response to the severe epidemic situation of the novel coronavirus pneumonia (COVID-19), Chinese governments at all levels rapidly issued several policies to control the epidemic and support the economy. On February 5, the executive meeting of the State Council decided to launch a series of fiscal and taxation policies in addition to the previously introduced measures, to ensure that there are sufficient supplies for the epidemic prevention and control work, effective from 1 January 2020.

为äºåºå¯¹ä¸¥å³»çæ°åå ç¶ç

æ¯ææçèºçç«æ

ï¼ä¸å½å级æ¿åºé¨é¨è¿

éååºï¼åºå°äºå¤é¡¹æ¿çæ件以æ§å¶ç«æ

ãæ¯æç»æµã2æ5æ¥å¬å¼çå½å¡é¢å¸¸å¡ä¼è®®å³å®ï¼å¨åæé对ç«æ

é²æ§å·²åºå°åæ¹é¢æªæ½çåºç¡ä¸ï¼åæ¨åºä¸æ¹æ¯æä¿ä¾çè´¢ç¨éèæ¿çï¼èª2020å¹´1æ1æ¥èµ·å®æ½ã

On February 7, the Ministry of Finance (MOF) issued four policies jointly with other departments:

On February 7, the Ministry of Finance (MOF) issued four policies jointly with other departments:

2æ7æ¥ï¼è´¢æ¿é¨ä¼åå¤é¨é¨ï¼å

±ååå¸äºå项æ¿çï¼

⢠Public Notice Jointly Issued by the MOF and State Taxation Administration (STA) Regarding Tax Policies to Prevent and Control the Outbreak of COVID-19 (the MOF and STA Public Notice [2020] No. 8)

⢠财æ¿é¨ãç¨å¡æ»å±å

³äºæ¯ææ°åå ç¶ç

æ¯ææçèºçç«æ

é²æ§æå

³ç¨æ¶æ¿ççå

¬åï¼è´¢æ¿é¨ãç¨å¡æ»å±å

¬å[2020]8å·ï¼

⢠Public Notice Jointly Issued by the MOF and STA Regarding Tax Policies for Donations to Prevent and Control the Outbreak of COVID-19 (the MOF and STA Public Notice [2020] No. 9)

⢠财æ¿é¨ãç¨å¡æ»å±å

³äºæ¯ææ°åå ç¶ç

æ¯ææçèºçç«æ

é²æ§æå

³æèµ ç¨æ¶æ¿ççå

¬åï¼è´¢æ¿é¨ãç¨å¡æ»å±å

¬å[2020]9å·ï¼

⢠Public Notice Jointly Issued by the MOF and STA Regarding Individual Income Tax Policies to Prevent and Control the Outbreak of COVID-19 (the MOF and STA Public Notice [2020] No. 10)

⢠财æ¿é¨ãç¨å¡æ»å±å

³äºæ¯ææ°åå ç¶ç

æ¯ææçèºçç«æ

é²æ§æå

³ä¸ªäººæå¾ç¨æ¿ççå

¬åï¼è´¢æ¿é¨ãç¨å¡æ»å±å

¬å[2020]10å·ï¼

⢠Public Notice Jointly Issued by the MOF and the National Development and Reform Commission (NDRC) Regarding the Exemption of Certain Administrative Fees and Government-managed Funds (the MOF and NDRC Public Notice [2020] No. 11)

⢠财æ¿é¨ãå½å®¶åå±æ¹é©å§å

³äºæ°åå ç¶ç

æ¯ææçèºçç«æ

é²æ§æé´å

å¾é¨åè¡æ¿äºä¸æ§æ¶è´¹åæ¿åºæ§åºéçå

¬åï¼è´¢æ¿é¨ãå½å®¶åå±æ¹é©å§å

¬å[2020]11å·ï¼

The policies focus on manufacturers of epidemic prevention and control supplies, relevant transportation companies and medical companies, etc., and aim at lowering the production and operation cost for the relevant enterprises, energising the expansion of supply of epidemic prevention materials, and medical and pharmaceutical supplies. We will share with you the key points of these tax policies and our insights.

The policies focus on manufacturers of epidemic prevention and control supplies, relevant transportation companies and medical companies, etc., and aim at lowering the production and operation cost for the relevant enterprises, energising the expansion of supply of epidemic prevention materials, and medical and pharmaceutical supplies. We will share with you the key points of these tax policies and our insights.

æ¿ç主è¦çåäºé²ç«ç¨åç产ä¼ä¸ãç¸å

³è¿è¾ç©æµä¼ä¸ãå»çä¼ä¸çï¼å©åç¸å

³ä¼ä¸è¿ä¸æ¥éä½ç产è¿è¥ææ¬ï¼æ¨å¨é²ç«ç©èµåå»è¯äº§åå 大ä¾ç»ï¼ä¸ºåå³æèµ¢ç«æ

é²æ§é»å»ææä¾æ´å¥½æ¯æãå¨æ¬æä¸ï¼æ®åæ°¸éå°ä¸æ¨å享ç¸å

³ç¨æ¶æ¿çè¦ç¹åæ们çè§å¯ï¼å©å大家å

±æ¸¡é¾å

³ï¼

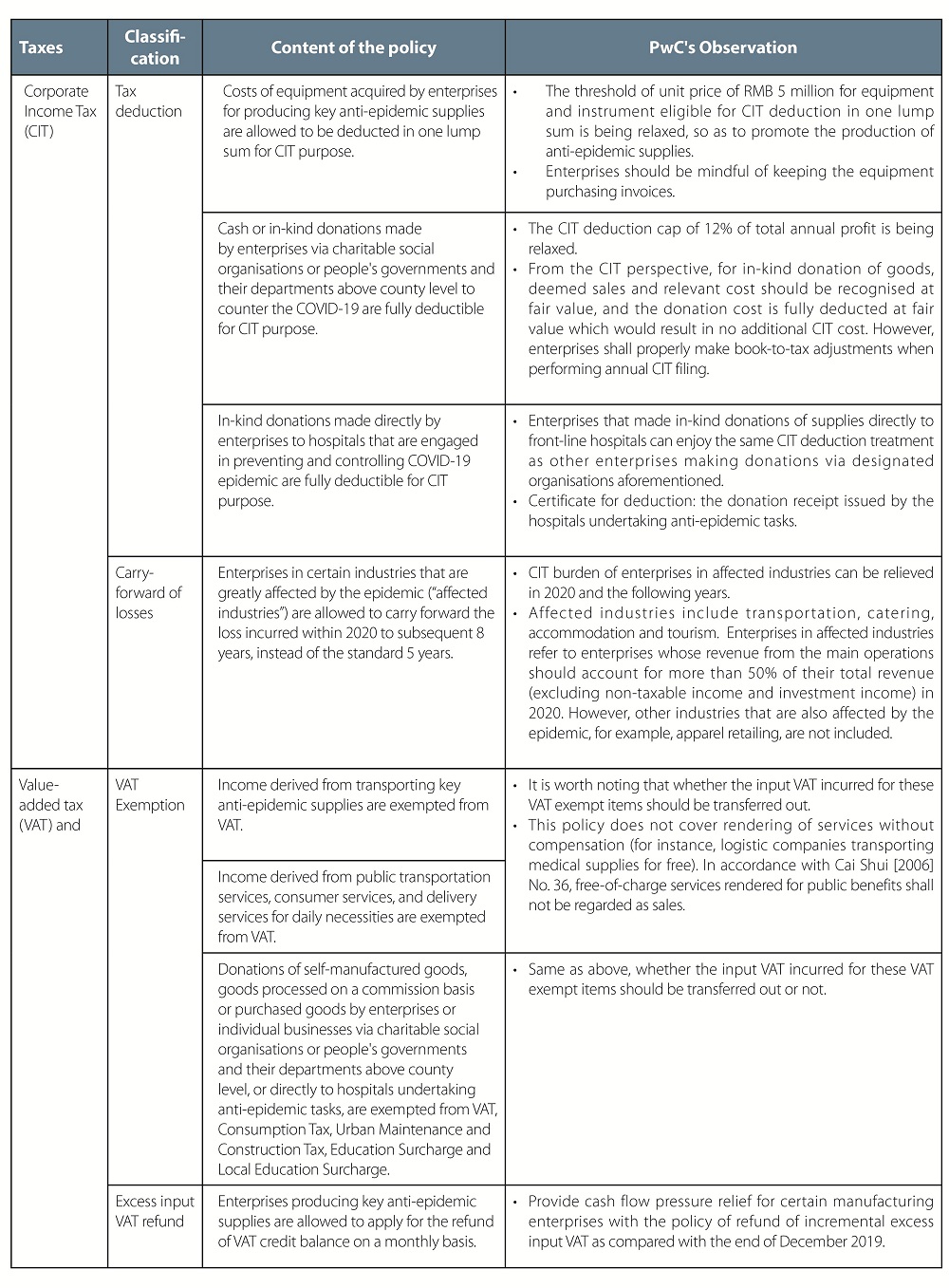

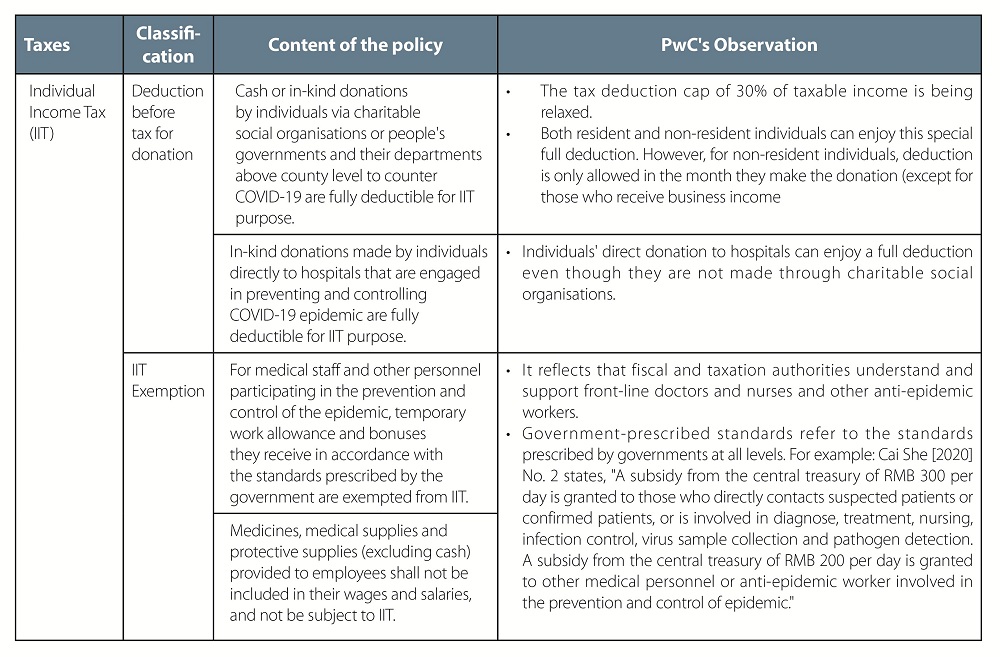

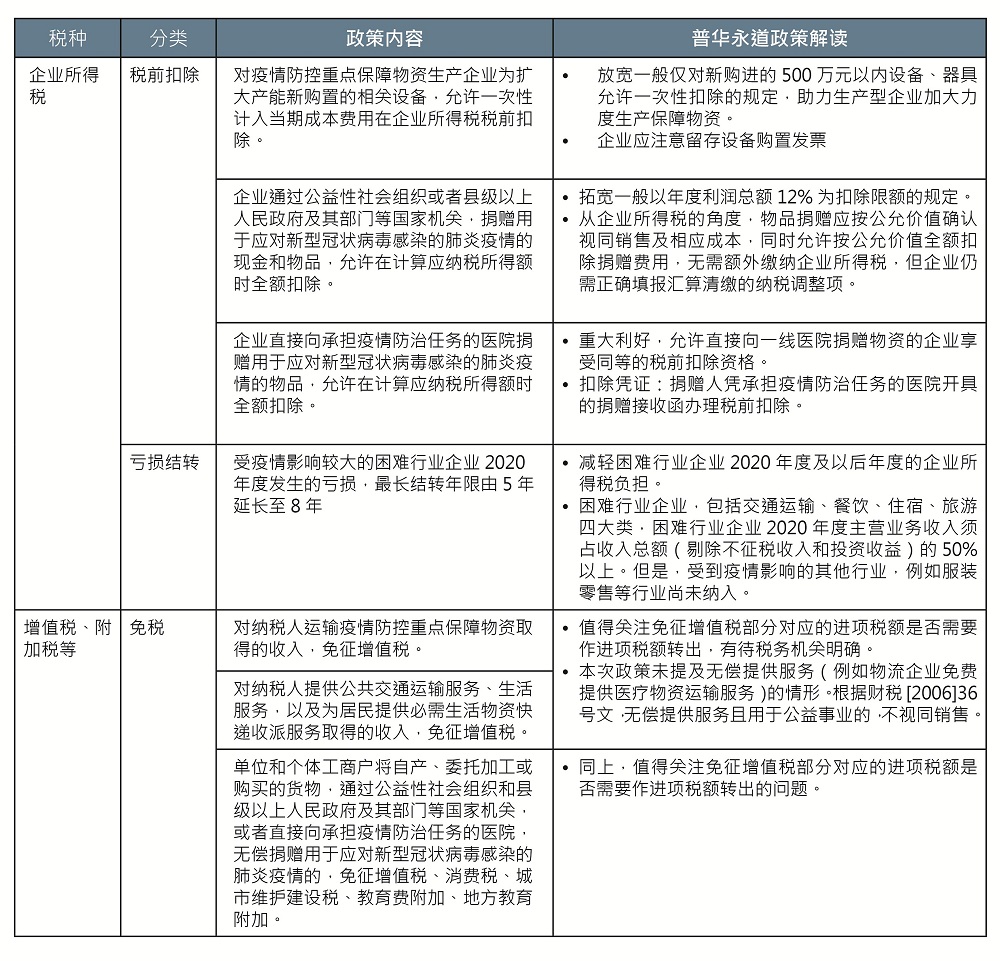

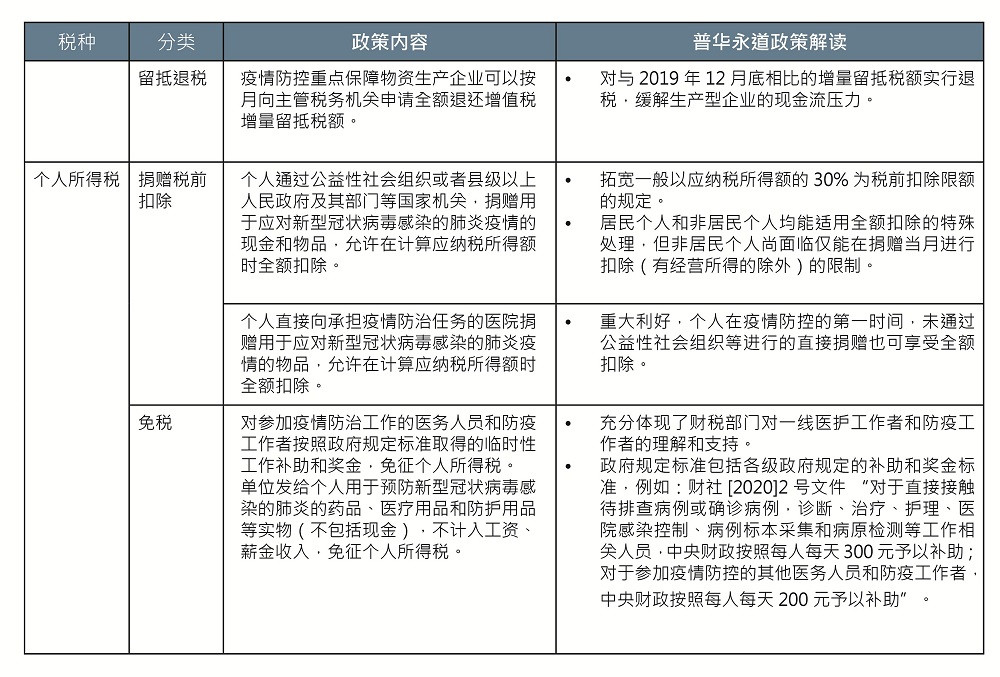

In the table below, we summarised the relevant tax policies (MOF and STA Public Notice [2020] No. 8, 9 and 10) and insights for your reference.

æ们å¨ä¸è¡¨ä¸æ´åäºç¸å

³ç¨æ¿ï¼8ã9ã10å·å

¬åï¼è¦ç¹åæ们çè§å¯ï¼ä¾æ¨åèã

The takeaway

The takeaway

注æè¦ç¹

In the process of implementing the above policies, we expect relevant authorities to define the list of "enterprises producing key anti-epidemic supplies" and the specific scope of "key anti-epidemic supplies" as soon as possible. In accordance with the Urgent Circular on Strengthening the Funding Support for Enterprises Producing Key Anti-Epidemic Supplies (Cai Jin [2020] No. 5) issued in the evening of 7 February jointly by the MOF, NDRC, Ministry of Industry and Information Technology, People's Bank of China, and the National Audit Office, provincial authorities can issue the list of local qualified enterprises on their own. It is recommended that the process for enterprises' independent application should be implemented as soon as possible, as well as allow special process in case of emergency. In addition, we also suggest that relevant local government departments and tax authorities should actively publicise and promote the aforementioned policies and implementation measures to taxpayers through online channels.

å¨è½å°æ§è¡ä¸è¿°æ¿ççè¿ç¨ä¸ï¼æ们æå¾

ç¸å

³é¨é¨å°½å¿«è½å®âç«æ

é²æ§éç¹ä¿éç©èµç产ä¼ä¸âçåååâç«æ

é²æ§éç¹ä¿éç©èµâçå

·ä½èå´ãæ ¹æ®2æ7æ¥æåå¸çãè´¢æ¿é¨ãåå±æ¹é©å§ãå·¥ä¸åä¿¡æ¯åé¨ã人æ°é¶è¡ã审计署å

³äºæèµ¢ç«æ

é²æ§é»å»æ强åç«æ

é²æ§éç¹ä¿éä¼ä¸èµéæ¯æçç´§æ¥éç¥ãï¼è´¢é[2020]5å·ï¼ï¼ç级ç¸å

³é¨é¨å¯èªä¸»å»ºç«å°æ¹æ§ä¼ä¸ååï¼å»ºè®®å°½å¿«è½å°ä¼ä¸èªä¸»ç³è¯·çæä½æµç¨ï¼ç´§æ¥æ

åµä¸å

许ç¹äºç¹åãå¦å¤ï¼æ们ä¹å»ºè®®åå°ç¸å

³æ¿åºæºæåç¨å¡æºå

³éè¿çº¿ä¸æ¸ é主å¨å纳ç¨äººå®£ä¼ åæ¨éè¿äºæ¿çåè½å°å£å¾ã

In order to ensure that enterprises can enjoy these policies, relevant enterprises need to review the completeness of their financial accounting and tax compliance. Take excess input VAT refund as an example, on the one hand, enterprises should prove their qualification of "enterprises producing key anti-epidemic supplies" with well-prepared documents; on the other hand, enterprises must pay attention to the accuracy of their accounting of input and output VAT, including the accuracy of the recognition of taxable income and the appropriateness of the historical taxable income, to accurately calculate the amount of tax refund and communicate tax refund affairs with the in-charge tax authorities as soon as possible. For the exemption policy with industry restrictions, enterprises should pay attention to whether their main operations fall within the exemption scope. Enterprises and individuals that have donated goods should pay attention to the keeping and submission of purchasing invoices, so that charitable social organisations and hospitals can determine the value of donated goods according to the invoices and issue donation receipts or donation acceptance letters.

为确ä¿ä¼ä¸å®å®å¨å¨äº«åå°è¿äºæ¿çï¼ç¸å

³ä¼ä¸é审æ¥èªèº«è´¢å¡æ ¸ç®çå®å¤æ§åç¨å¡ç³æ¥çåè§æ§ï¼ä¾å¦å¯¹äºçæµéç¨æ¿çï¼ä¸æ¹é¢ï¼ç¸å

³ä¼ä¸éè¦åå¤å¥½ææï¼ä»¥è¯æ符åâç«æ

é²æ§éç¹ä¿éç©èµç产ä¼ä¸âèµæ ¼ï¼å¦ä¸æ¹é¢ï¼ä¼ä¸åºæ³¨æ对äºè¿é¡¹é项çæ ¸ç®åç¡®æ§ï¼å

æ¬åºç¨æ¶å

¥ç¡®è®¤çåç¡®ç¨åº¦ååå²åºç¨æ¶å

¥æ°é¢çåçæ§ï¼ä»¥å确计ç®éç¨éé¢ï¼å°½å¿«åç¨å¡æºå

³æ²ééç¨äºå®ã对äºæè¡ä¸éå¶çå

ç¨æ¿çï¼ä¼ä¸é注æå¤æèªå·±ç主è¥ä¸å¡ç±»åæ¯å¦å¨æ¿ççèå´å

ãæèµ äºç©èµçä¼ä¸å个人ï¼é注æä¿å并æ交è´ä¹°ç©èµçéè´å票ï¼ä»¥ä¾¿å

¬çæ§ç¤¾ä¼ç»ç»åå»é¢ä¾æ®éè´å票确å®åèµ ç©èµä»·å¼å¹¶å¼å

·æèµ ç¥¨æ®ææèµ æ¥æ¶å½ã

In addition, to address the epidemic outbreak and its economic impact, we also expect authorities at all levels to continue to provide a larger scale of fiscal and taxation support to industries greatly affected by the epidemic (including but not limited to transportation, catering, accommodation, tourism, apparel retailing and other industries) and other enterprises that are not able to resume operation in time or in full capacity. At present, commonly concerned issues include: exemption and relief of Real Estate Tax and Urban Land Use Tax for trouble enterprises; considering the feasibility to lower the social security contribution rate by stages in addition to the delay of payment of enterprises' social security contribution; strengthening tax support for small and micro enterprises; increasing the deduction of R&D expenses related to epidemic in medical institutions and scientific research institutions by stages; granting the same excess input VAT refund policy to other R&D enterprises related to epidemic prevention and other enterprises greatly affected by epidemic. PwC will follow up on the financial and taxation policies relating to the prevention and control of epidemic, and share with you timely.

å¨ä¸è¿°æ¿çä¹å¤ï¼é¢å¯¹æ¤æ¬¡ç«æ

åå

¶ç»æµå½±åï¼æ们ä¹ææå级财ç¨é¨é¨åç»ç»§ç»å¯¹åç«æ

å½±åç¹å«é大çè¡ä¸ï¼å

æ¬ä¸ä¸éäºäº¤éè¿è¾ãé¤é¥®ãä½å®¿ãæ

游ãæè£

é¶å®ç诸å¤è¡ä¸ï¼ä¼ä¸åå

¶ä»æªè½åæ¶å

åå¤å·¥å¤äº§çä¼ä¸æä¾æ´å¤§ç¨åº¦çè´¢ç¨æ¯æ´ãç®åä¸å

éä¸å

³æ³¨çæ¹é¢ä¸»è¦å

æ¬ï¼å¯¹æ¿äº§ç¨ååéåå°ä½¿ç¨ç¨å®è¡å°é¾åå

ï¼å¨ç¼äº¤ä¼ä¸ç¤¾ä¿çåºç¡ä¸èè继ç»é¶æ®µæ§éä½ç¤¾ä¿è´¹çï¼å 大对å°å¾®ä¼ä¸çç¨æ¶æ¶æå度ï¼é¶æ®µæ§æåå»çæºæãç§ç æºæåççä¸ç«æ

ç¸å

³çç åè´¹ç¨æ£é¤æ¯ä¾ï¼é¤âç«æ

é²æ§éç¹ä¿éç©èµç产ä¼ä¸âä¹å¤ï¼å¯¹å

¶ä»é²ç«ç¸å

³çç åä¼ä¸ãåç«æ

å½±åé大çè¡ä¸ä¼ä¸åæ ·å

许享åå¢å¼ç¨å¢éçæµéç¨æ¿ççãæ®åæ°¸éä¹å°æç»å

³æ³¨ç«æ

é²æ§ç¸å

³çè´¢ç¨æ¿çï¼å¹¶åæ¶ä¸æ¨å享ã